Report Navigation

Free Previews are abridged to help users get a feel for Josef’s newsletter and the topics it contains. The navigation below is deactivated, and excerpted sample content has been added below. Full content is available to subscribers – subscribe today!

1. Stock Market Overview

New Year Report.

2. Fearless Forecasts for 2023

Looking Forward Into 2023.

3. Insider Trading

Insider Trading Report January 5, 2023.

4. Company Lists

Covered Companies & Valuation Analysis. Company Links.

5. Action Alert Lists

Action Alert Performance Reports, & Action Sell Lists.

6. Disclosure List

SERSI & Family/Staff Ownership Disclosure.

Welcoming Comments

The cut-off date for this SER report’s data was Friday January 5, 2023.

Josef Schachter

@lysle_photography

Goodbye ugly 2022. It was a tough year for the popular stocks (MEME, FAANG, Semi-Conductors and the Crypto world) which all ended down sharply. For the Indices the rout was the worst for the NASDAQ, down 33%. The Dow fell 9% and the TSX fell by 9% as well. The large cap S&P 500 fell by 19%. Energy stocks did well during the first half of 2022 but then got beat up sharply in the second half as crude oil retreated from its wartime high US$130.50/b. It fell to a low of US$70.08/b in December but did not breach the US$70/b level which would have triggered a BUY signal for us. If it had, we were expecting to have returned to the bullish camp and added materially to our Action BUY List.

In our view the key market bottom we are waiting for is just delayed but will not be denied.

We expect to see a difficult and wildly gyrating Q1/23 for the markets as overall earnings and earnings guidance disappoints, as the Fed remains hawkish on fighting inflation, and as recession spreads around the world (more on this in the Fearless Forecast section).

WTI closed last Thursday at US$73.67/b with an intraday low of US$72.46/b. We are looking for the following key indicators to turn bullish and as more of them kick in we will add more ideas to our Action Alert BUY list. Many stocks have fallen into their BUY ranges as we note on the Coverage List page but we want to see at least one of the following to occur before we start sending out BUY recommendations. As more of these kick in we will send out additional BUY ideas.

These indicators and target levels are:

- The price of WTI falls below US$70/b (bottoming range US$65-US$70/b).

- The TSX Energy Index falls below 200 (closed Thursday January 5th at 227). We expect a panic waterfall decline to go to the 170-190 range on a spike down. Remember in 2020, we had a spike down in just the month of March of 90 points and in June/July 2022 we had one of 90 points as well. Falling during December/January by 90 points get us down to 170 (from the high at the start of December at 260).

- The S&P Bullish Percent Index falls below 10% and sets off a BUY signal. If it fall below 5% it becomes a Table Pounding BUY signal. In March 2020 it fell to 3.7% which added to our confidence to becoming clamorous bulls.

By the time this reaches you we may have already seen one of these indicators and you will have gotten your first Action Alert list. If not, it should happen soon so decide which names meet your portfolio needs and be ready to build your positions. There are some ideas currently on the BUY list and on the SER Ownership list you can see we are building a position in Pipestone Energy for our personal portfolios. We want more exposure to large natural gas reserves in the Montney basin. We expect to have over 20 ideas on the Action BUY list in the coming weeks.

Get your BUY lists ready – it will soon be time to pounce on the bargains again!

Remember stock markets discount things quickly taking prices through greed to fear levels. A breach of US$70/b and staying there for even a short time will be problematic for cash flows and energy stock prices. The short sellers will go after high cost oil producers and those that still have too much debt. A waterfall plunge phase could occur like as happened to the tech world last year and as happened to energy in other market rout periods like the pandemic and the GFC etc.

To Buy or Not to Buy

| VALUE | + | SENTIMENT | + | TECHNICALS | = | OVERALL |

|---|---|---|---|---|---|---|

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

Green Light to Buy

Cheap valuations, Sentiment not bullish, Technicals very attractive

Yellow Light for Caution

Some wavering on parameters, or parameters not clear. Some stocks may be attractive, others not so

Red Light to Stop or Sell

Parameters bearish, stay away, sell down, warning to wait for the next buy signal

Click here to launch the Research Process in another tab for detailed definitions and checklist items

1. Stock Market Overview

New Year Report.

Get your BUY lists ready – it will soon be time to pounce on the bargains again! Remember stock markets discount things quickly taking prices through greed to fear levels. A breach of US$70/b and staying there for some time will be problematic for cash flows and energy stock prices. The short sellers will go after high cost oil producers and those that still have too much debt. A waterfall plunge phase could occur like as happened to the tech world last year and as happened to energy in other market rout periods like the pandemic and the GFC etc.

Let’s look at the two key energy components we are watching.

First WTI. In (Chart #1) you can see the Daily chart of 2022 to now. It shows the high of US$130.50/b after Russia invaded Ukraine and then the back and forth as the fighting ensued. Once it appeared that Russia was not succeeding in the invasion prices retreated from June onward. The fear that there would not be sufficient crude after sanctions were installed against Russia has not been realized as recession worries and releases of strategic reserves has occurred. Just look at the chart and you can see the sharp rallies and sharp declines. In November/December of 2022 WTI fell by over US$23/b to US$70.08/b. It rallied in the next few weeks to US$81.50/b and now has started the next decline. We see this decline taking the WTI crude price below US$70/b with a bottoming range of US$65-US$70.

Second the S&P/TSX Energy Index. In (Chart #2) you can see the Daily chart of the Index of 2022 to now. It shows the same high volatility as the price of crude. The peak was in June at 288. It closed last Thursday at 227 or down by 21%. We expect that the coming low will be below 200 and plunge in a waterfall decline to the 170 – 190 range. In (Chart #3) you can see the weekly chart and the large swings. The worst of the rapid decline should occur once the price of WTI breaches US$70/b. As we cover in our weekly ‘Eye on Energy’ piece there is demand destruction around the world and global demand is likely down by 3-4Mb/d now and will likely fall 5-7Mb/d as the global recession gets worse. Proof of this was seen in last week’s EIA Petroleum Report that showed US demand alone had fallen 1.5Mb/d or down by 7.6% from the prior year. Motor Gasoline demand in the US was down by 8.1% from last year. We suspect China’s data is even worse given the massive outbreak of Covid (over 250M cases with large numbers of deaths). So, the two largest world economies are leading the decline in consumption.

Energy bulls have been focusing on supply problems but now it is clear that the market is also looking at demand destruction. The pendulum has swung from chasing the sector, to profit taking, and to now selling as the price of crude and natural gas retreat. As this fear and dumping of shares occurs, we are getting excited as bargains are developing with many stocks down 50% or more from their June 2022 highs.

Charts in the subscriber newsletter are full sized. Thumbnails shown here only for reference.

Chart #1

WTIC US$/b – Daily

Chart #2

S&P/TSX Energy Index – Daily

Chart #3

S&P/TSX Energy Index – Weekly

For Your Amusement

Source: theweek.com, December 2022

2. Fearless Forecasts

The Fed and other Central Banks will continue the war against inflation in 2023. The price of money will rise through the first half and there may be three or more increases in the Fed Funds rate. After that, the Fed should maintain that high rate into year-end. They will also continue to remove money from the system via Quantitative Tightening (QT), removing US$95B/month or over US$1.1T through the year, which is more than 5% of GDP. We will have less liquidity and higher interest rates.

Inflation will persist for food, shelter and wages in the first half of 2023 and then should recede. In 2H/23 we see commodity inflation picking up, which will force Central Banks to remain hawkish. Economic recovery is expected in 2H/23.

The war drums will get worse in 2023 impacting stock markets, especially in the first half. The easy issues are Ukraine/Russia and China/Taiwan but we see trouble brewing between Iran/Israel, North Korea/South Korea and or Japan, and Serbia/Kosovo. Any one of these, or others, could ignite into some form of disruption or even warfare.

World stock markets will see pressure in the first half due to the global recession, supply chain problems, employee strikes for pay increases above inflation, and climate problems. For example, we still see the Dow Jones Industrials falling below 30,000 and plunging to a climactic bottom in the 25,000 – 26,000 area. When, not if, is the issue for us.

Commodity prices should recover strongly in 2H/23 as global economies come out of recession and the juggernaut China handles Covid. Copper and other metals should do well, but energy should be the star. We see WTI breaching US$90/b in Q3/23 and over US$100/b at the end of the year. The TSX Energy Index should recover to the 275 area (from the upcoming low below 190) in Q3/23 and breach 300 in late 2023.

Many of the stocks on our expanded Action BUY list (once fully up over 20 names) should see gains of over 50% (capital gains and dividends) into the end of the year. Some may even be doubles or better depending upon where they bottom. Compare the Action Alert BUY priced to our one-year targets for upside potential.

Six main reasons we still see downside in the near term:

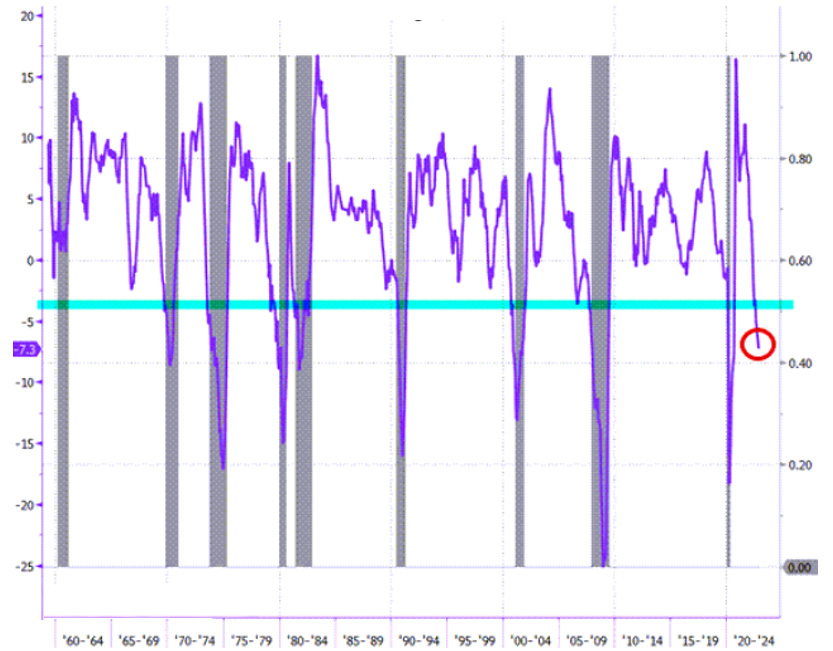

- The US Conference Board Leading Economic Index (LEI) (Chart #4) has been down for eight months in a row and fell in November by an additional one percent. Historically extended LEI declines have always led to a recession.

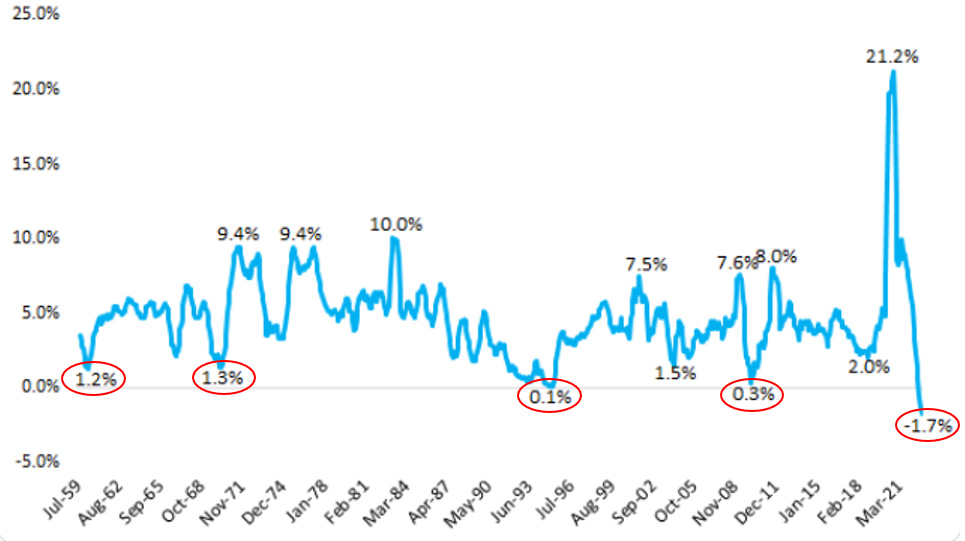

- The US Money Supply has fallen 1.7% over the last eight months and will fall even more now that QT is more aggressive (Chart #5).

- Recessions in the past have occurred with money supply growing at an anemic 2% or less.

Europe may face some of the severest recession problems due to the high cost of electricity and union strikes (Chart #6).

Charts in the subscriber newsletter are full sized. Thumbnails shown here only for reference.

Chart #4

US Leading Index Points To Recession

Chart #5

Negative Money Supply Adds To Recession View

Chart #6

Recessions in Europe in 2023

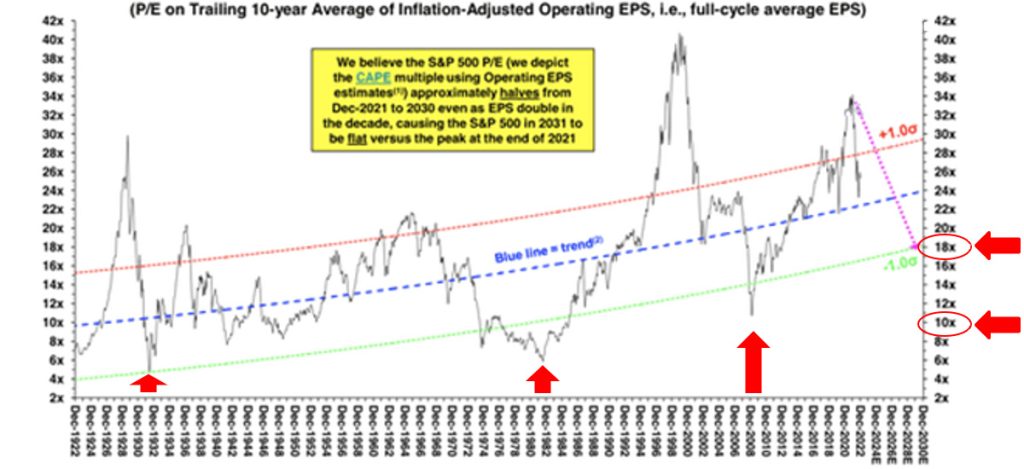

- While stock prices have come down, price to earnings (P/E) ratios are still higher than seen at market bottoms. Historically the S&P 500 bottoms around 18x earnings (Chart #7). With 2023 earnings forecast at US$190-US$200 for the year (the lower the level the worse the earnings recession) that would put the target downside at 3,420. It closed at 3,808 last Thursday indicating downside of 10%. However, if we fall to the GFC low of 10x then the downside is to 2,000 or less. Our forecast is for a decline to the 3,100 level or a further decline of 19%. See the chart for other bottom P/E ratios.

- Apple the former largest cap at US$3T is now down by 31% and has lost US$1T from its 2022 high (Chart #8). With problems in China and a recession impacting demand, its robust P/E ratio (24x) is no longer accepted by the market. It has a 6% weighting in the S&P 500 and an 11% weight in the NASDAQ. We think the stock could fall to below US$95 per share if earnings and guidance disappoint. It recently fell below the prior 2022 low of US$128.49 and closed last Thursday at US$125.02. A falling Apple will hurt all the US indices and cause a nasty plunging market.

- TESLA, the EV darling, (Chart #9) has been pummeled by the stupid antics of its founder Elon Musk. He has become distracted by his Twitter investment and the lofty multiple at TSLA has fallen as this genius is seen as an absentee. The stock has fallen 73% to US$110 per share from its 2021 high of US$414.50 per share. With sales softening due to the recession and product price discounts we think the stock could fall to below US$90 per share as more competition comes on stream in 2023 and the robust multiple gets hammered even more as the Musk premium valuation dissipates.

Charts in the subscriber newsletter are full sized. Thumbnails shown here only for reference.

Chart #7

US Stocks Still Overvalued

Source: investmentwatchblog.com January 3, 2023

Chart #8

Apple - Weekly

Chart #9

TSLA - Weekly

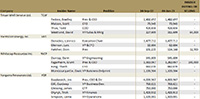

3. Insider Trading

Review: Buying & Selling

After the significant decline in the energy markets we thought it was again time to see what management and insiders were doing with their investments in their company stock. We include all the Canadian companies we cover in this review and have broken down the information under Buyers and Sellers; while highlighting only those companies with significant investment changes by key insiders (the number of shares invested or divested). With stock bargains developing we are seeing more consistent buying by many managements. This was something we have been waiting to see and was one of our checklist items for us to return to the BULL camp.

Charts in the subscriber newsletter are full sized. Thumbnails shown here only for reference.

insider trading

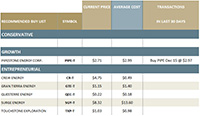

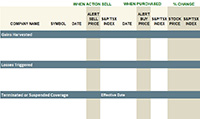

4-6. Lists

Charts in the subscriber newsletter are full sized with additional context. Thumbnails shown here only for reference.

Company coverage list

Valuation

list

Action Alert performance

Action Alert performance

Disclosure chart