Global Economic, Political & Military Update

Bearish commentary from the Fed meeting notes and repetitive comments by Fed officials that they see no reason to lower interest rates in the near term has spooked markets. There have even been some officials saying that higher rates may be needed if inflation persists or goes higher. This is a big change from prior more optimistic pronouncements. The US 2-year yield has risen over 25 BP over the last two weeks from 4.71% to 4.98% yesterday. There are forecasters concerned that if the 2-year exceeds the 2024 high of 5.05%, on a close, we could see a stock market correction of some substance. The stock market is taking the hatchet to companies that show disappointing results. Yesterday Salesforce had results that annoyed investors with revenues missing guidance and the July quarter forecast much below street estimates. The stock is down 21% today. The Dow fell 411 points yesterday to 38,442, and today is down 380 points to 38,061. Overall the Dow is now down over 2,000 points from the high two weeks ago at 40,077. The upcoming inflation data will be scrutinized to see if the direction of inflation and rates is now on the upswing once again.

Some of the new economic data points we are watching include:

- The Fed meeting minutes of the April 30-May 1st meeting noted that “the recent monthly data had shown inflation was more stubborn than officials had expected at the start of 2024”. The minutes noted “the recent monthly data had showed significant increases in components of both goods and services price inflation”. Various participants mentioned a willingness to tighten policy further should risks to inflation materialize.

- It appears that the US is experiencing a ‘selective recession’ as lower income consumers can’t cover the cost of living. CNBC noted that a recent survey showed that “over 70% of low-income consumers right now are saying that they are struggling to make ends meet”. A measure of this is that 11% of Americans are on Food Stamps. This is over 42M people.

- One sign of growth is in the Manufacturing sector as the May flash PMI rose to a two year high of 54.4 up three points in a month. Another is that Durable Goods Orders rose 0.7% in April versus a forecast of a negative 0.9%.

- Recent US Treasury auctions have been poorly received and have traded above yields before the auctions. Too much paper is being thrown at the market and investors are balking at the low rates. Bond vigilantes want yields over inflation and bad news on that front means higher interest rates going forward.

- This morning US GDP for Q1/24 was reported up only 1.3% and down from a 3.2% rise Q4/23.

On the wars front:

- Crude oil’s war premium has expanded as Israel’s incursion into Rafah has caused substantial civilian casualties. Red Sea attacks on shipping have also picked up.

- The US built pier has broken up in rough seas and less emergency food supplies are now getting to the desperately needy Gaza civilians. One problem has been that when supplies do get in, Hamas and gangs have taken the supplies from the agencies distributing the goods. The 2.5 million desperate civilians are not on the receiving end of much of this aid.

- Iran has sent the Houthi militants in Yemen long range weapons that can hit targets in the Mediterranean, so more targets and areas for shipping attacks.

- China has increased its military exercises around Taiwan and their media is getting the public ready for an invasion of Taiwan as early as next month.

- Lithuania is planning to send troops to Ukraine for training purposes but Russia has warned that any NATO troops in their countries uniforms will be targeted. France already has mercenaries fighting in foreign brigades. Ukraine has used the newest long range weapons to strike Russian nuclear infrastructure. So far the attacks have been against a radar station at Krasnodar that monitors long range missiles. Knocking these out blinds Russia’s ability to see attacks coming and may make them even more paranoid about NATO’s intentions.

Market Update: We are watching the economic data carefully as it appears that consumers are getting tapped out and this could drag down the economy at some point. The offset is the 6% US deficit and large war spending that are keeping some areas of the US, with hot economies. The military industrial complex are happy campers these days.

Energy stocks peaked in early April as crude reached its high of US$87.67 on the mideast war premium expansion. The run from early February was very rewarding and the ideas on our SER BUY List for the most part did very well. We see the general market and the energy sector as vulnerable. A correction should occur and that would provide the next low risk BUY signal which we see occurring during Q3/24. The S&P/TSX Energy Index peaked at 308 in week two of April and has fallen today to a low of 295 yesterday. A downside target below 240 in the coming months is likely. The overbought condition can be confirmed from the S&P Energy Sector Bullish Percent Index which rose from 39% bullish in February 2024 to 91% three weeks ago. Recent weakness has pulled this Index down to 59% yesterday. Over 90% is an overbought reading. It should decline below 20% to give off an oversold level and a BUY window once again.

Our new SER issue feature called ‘TOP PICKS NOW’ highlights the best ideas at the time of each SER report. The ideas have worked out very well as not all stocks rise and peak at the same time nor do they bottom at the same time. If you want to see what our subscribers are looking at, sign up now for access to the Schachter Energy Research reports

BULLISH PRESSURE

1. The potential for an expansion in the Middle East war. Iran lost their President in a helicopter crash and the question becomes does a more radical person (IRGC) become the President. Recent reports indicate that a more anti-western leader may be chosen.

2. The Ukrainian success in attacking refineries in western Russia.

3. The Iranian backed Houthis Red Sea and Gulf Of Aden attacks on shipping have increased.

4. OPEC is planning to extend its official cuts to the end of 2024 with the hope this tightens up global inventories and raises oil prices much further. They hold a virtual meeting on June 2nd. Compliance however is still a problem and there is now more than adequate world supplies.

5. The area to watch now is China demand. It is quite weak now but could rebound if the government's stimulus moves take hold.

6. The US Hurricane season is forecast to be a bad one this year. If it is, more than 15% of US production (1.8 Mb/d offshore) could get shut in for periods of time.

BEARISH PRESSURE

We expect a decline below US$75/b based upon fundamentals as demand falls during the spring shoulder season by 2.0 - 2.5 Mb/d. Note the build in Total US Stocks this week (next section). For a refresher, during the last correction WTI fell (in December) to an intra-day low of US$67.71/b from US$79.60/b from just a few weeks before. In 2023, WTI fell from US$83.53/b in April to US$66.80 in June. In 2021, crude fell from US$76.98 in June to US$61.74/b in August. Today’s intraday low was US$77.84/b.

If a ceasefire and hostage release is obtained during the talks sponsored by Egypt, Qatar and the US we may see a fall in prices of US$5-6/b as a result of this action alone. Overall we could see prices US$10/b lower than today if events unfold successfully.

So remain patient and let the market do its normal swinging around and use the next period of market and energy price weakness to build up your energy weightings.

EIA Weekly Oil Data

The EIA data released today May 30th showed material increases in overall inventories. US Total Stocks rose 13.2 Mb despite a rise in Refinery activity to 94.3% from 91.7%. The Strategic Reserve showed an increase of 0.5 Mb on the week to 369 Mb and is above last year’s level by 13.9 Mb. Motor gasoline inventories rose 2.0 Mb and are now 12.8 MB above 2023 levels. Distillate fuels saw a rise of 2.5 Mb and are 12.6 Mb above last year’s storage levels. Commercial crude stocks fell 4.2 Mb as refiners took down inventories to make products. Total Stocks including the SPR are now 34.1 Mb above last year or at 1,632.5 Mb. Cushing inventories fell 1.7 Mb to 34.6 Mb. US Exports fell 505 Kb/d to 4.23 Mb/d.

US Crude production was flat at 13.1 Mb/d and is up 900 Kb/d above last year’s level. Motor Gasoline consumption fell by 166 Kb/d to 9.15 Mb/d while Jet Fuel saw a rise of 198 Kb/d to 1.85 Mb/d. Total Demand fell 547 Kb/d to 19.4 Mb/d as Propane demand fell 346 Kb/d and Other Oils fell 346 Kb/d. Year-to-date US demand is up 0.2% to 19.86 Mb/d. US inventories are sufficient for this summer’s pick-up in demand.

EIA Weekly Natural Gas Data

The natural gas report out today showed a lower storage rise than expected. The increase was 84 Bcf, with the largest rise in the East at 27 Bcf. This compares to an injection of 110 Bcf last year and the 5-year average injection rate of 80 Bcf. Storage is now at 2.42 Tcf. US Storage is now 15.7% above last year’s level (down 3.3% points in a week) and is at 26.5% (down 2.3% points in the week) and above the five year average of 2.21 Tcf.

NYMEX is today priced at US$2.59/mcf. The recovery was due to the Freeport Texas LNG facility reopening and exports rising. Demand in Asia is picking up and Egypt is now importing more LNG as it is in short supply ahead of an expected very hot summer season and high air-conditioning usage.

We recommend buying the very depressed natural gas stocks during periods of market weakness (these stocks are very cheap now) as we see higher natural prices in Q4/24 (above US$3.00/mcf) and much higher prices in 2025. We plan to add additional natural gas names to our Action BUY list when we get the next low risk energy BUY signal.

Baker Hughes Rig Data

In the data for the week ending May 24th, the US rig count finally saw a decline of four rigs to 600 rigs (they rose one rig in the prior week). Rig activity is now 16% below the level of 711 rigs in 2023. Of the total rigs working last week, 497 were drilling for oil and this is 13% below last year’s level of 570 rigs working. The natural gas rig count is down 28% from last year’s 137 rigs, now at 99 rigs due to the weak natural gas prices at this time. This sharp decline in drilling should continue for a few more months but the industry is seeing declining production. Recent data shows US daily natural gas production for May at 95.5 Bcf/d down from the high in December 2023 of 105.5 Bcf/d. Once storage comparisons improve we should see natural gas prices lift even faster.

In Canada, there was an increase of six rigs to 120 rigs working (versus a decline of two rigs last week). Canadian activity is up 38% from last year’s 87 rigs. Activity for oil is at 64 rigs compared to 42 last year or up by 52% as companies add more oil to meet TMX pipeline heavy crude demand and diluent to move the crude. Activity for natural gas is at 56 rigs compared to 45 last year and condensate rich wells are the focus of this activity. The industry needs north of $2.50/mcf (now AECO $1.30) to see the economics attractive to drill more gas wells. As we get closer to LNG Canada ramping up in Q4/24 and natural gas fills the Coastal GasLink pipeline, prices should lift.

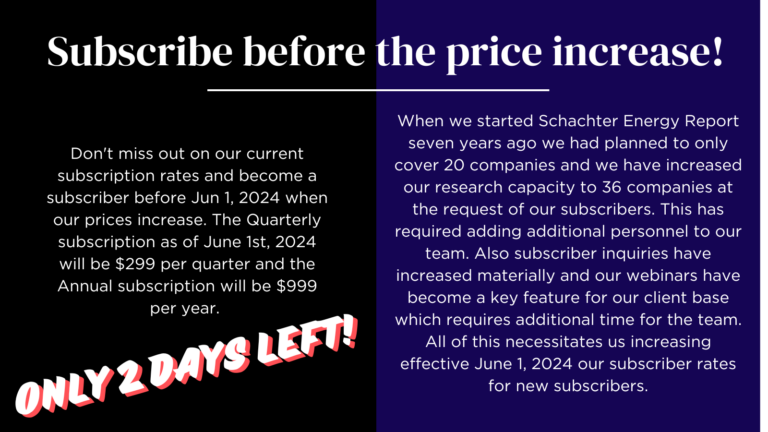

Current subscribers will not be affected by the price change as long as they keep an active subscription. Subscribers who sign up before Jun 1, 2024 will be grandfathered in at the original prices of $249 per quarter or $799 per year as long as their subscription remains active.

Energy Stock Market

The S&P/TSX Energy Index today is at 296. We would not chase the sector here but wait for the developing correction to lower prices and then add to portfolios. We are bulls but we don’t want to chase stocks. We like to BUY when stocks are cheap and are being ignored. That is not the case now. There still are some stocks that are BUYS but that list has shrunk. We cover those that remain cheap in our TOP PICKS NOW section of our SER reports.

Investors should decide what you want your energy weighting to be for this long energy super cycle. Our BUY List includes ideas from the Pipeline & Infrastructure area, Canadian oil and natural gas ideas, energy service ideas and companies working internationally. Our list includes large Conservative ideas and small to large caps in our Growth and Entrepreneurial categories. Add to your current ideas or add new ideas. We expect that WTI should lift above US$90/b in 2H/24 as winter 2024-2025 demand should exceed supplies at that time and we see recovering economies globally.

CONCLUSION

Please take advantage of the current SER pricing structure to become a subscriber before our price increase on June 1st. We are in an exciting energy super cycle and there is a lot more to the upside. To get our specific views and to learn about the companies we cover, become a subscriber. Getting a subscription will help you navigate your energy investments as this cycle unfolds into the end of this decade.

WTI is priced now (as we write this report) at US$77.95/b. Near term we see a break of US$75/b occurring as inventories build during this shoulder season. We expect to take advantage of the bargains in energy stock prices with new BUY ideas if one more of our BUY signals is triggered. Down market days for energy stocks are the best days to build your positions for the lengthy energy super cycle we see lasting into the end of the decade.