Important Update: Eye on Energy is Evolving

This is the last free issue of Eye on Energy. Beginning next week, Eye on Energy will only be available to paid subscribers on Substack. If you want to continue receiving our weekly insights, now is the time to subscribe and secure uninterrupted access.

We have been publishing Eye on Energy as an extension of the Schachter Energy Report to provide timely and expanded insights on the Energy and World Market. Over time, the volume of information and the effort required to produce this report have grown significantly. As a result, we are transitioning Eye on Energy to a paid subscription model on Substack to ensure its continued quality and sustainability.

Transition to Substack:

You are now receiving the free version of Eye on Energy via Substack, rather than through our previous email distribution platform. While the format will look slightly different, the content and value will remain the same. Please note that the email will come from a new address: josefschachter@substack.com. We recommend adding this email to your safe senders list to ensure it arrives in your inbox. You can also read Eye on Energy at:

Only 1 Week of Free Access Left!

Free access ends on September 10, 2025.

After that date, subscriptions will be available at:

$30/month or $250/year via Substack.

Don’t miss an issue — subscribe before the deadline to keep your access uninterrupted.

To subscribe on Substack go to https://josefschachter.substack.com/

Special Note for Schachter Energy Report Subscribers:

If you are a current subscriber to the Schachter Energy Report, you will continue to receive Eye on Energy as part of your Black Gold subscription at no additional cost.

Limited-Time Offer:

From now until September 30, we are offering a special promotion for those interested in becoming Black Gold subscribers. New annual subscribers will receive $100 off their first year. To redeem this offer, enter coupon code SER100 at checkout using the link below:

https://schachterenergyreport.ca/subscriptions/

We sincerely thank all of our readers for your continued interest and support.

Warm regards,

The Schachter Energy Report Team

Global Economic, Political & Military Update

WTI Crude oil prices are steady at US$63.44/b (low today US$62.72/b) compared to US$63.66/b last week at this time. President Trump’s window for Russia to agree to peace talks with Ukraine have gyrated energy prices. President Putin has invited President Zelensky to Moscow but this is not as safe as where Zelensky wanted, Switzerland.

Crude oil continues to face downside pressure as we enter the Fall season when demand weakens from the strong summer period of consumption. We see a breach of US$60/b in the near term. (More on this below).

The ongoing US stock market rally (new highs recently for S&P 500, the NASDAQ and the Dow Jones) has been focused on the AI and tech sectors and is very narrow in leadership. With sluggish economic data especially in the consumer areas, we suspect we could see a 20%+ general stock market correction (led by tech) over the coming months. Investors should have cash reserves and be ready for a material market correction. It is likely to get very nasty during September/October! Caveat Emptor! More on this below.

This week’s ‘Eye On Energy’ Important Details:

ECONOMIC

President Trump’s tariff policy got the shaft from a Federal Appellate court that ruled that the tariffs were unconstitutional. A quick run to the Supreme Court is expected by his Justice Department. If tariffs are not allowed then the cost US$300B/year may have to be refunded to companies and the deficit will grow accordingly. The bond markets were upset and the 30-Year US Treasury Bond neared 5%. If it breaches that level it would be a problem for financing the deficits and raise US borrowing costs.

The jobs report for August comes out this Friday. Economists forecast a 75,000 increase (73,000 in July). Any revisions will be closely monitored. Job openings fell 176,000 in July according to the Labor Department Bureau of Labor Statistics. Those unemployed now exceed the job openings (7.24M versus 7.18M). The ADP report out today showed a slowing job market. August saw only 54,000 jobs added versus the 75,000 in the forecast. Job losses (17,000) occurred in trade, transportation and utilities.

The Congress has to extend the debt ceiling this month. If not extended, a government shutdown is possible.

US core inflation rose 2.9% in July, hotter than the June number.

US Insiders trades were all on the sell side last week (200 sells, 0 buys). A clear market signal to be noted.

AI spending is not seeing profits by its users. Many highlight their use which helps the AI developers but the dollars spent may be wasted. Many companies brag about the use of AI but hide the high costs.

Gap’s stock got hammered as the retailer missed sales expectations and warned that tariffs are impacting profits (US$150-US$175M).

Canada’s economy may already be in recession as Q2/25 came in at a negative 1.6% due to a sharp drop off in exports and business investment. Net exports took 8.1% off real GDP growth as vehicles, industrial machinery and travel services fell sharply.

2. GEO-POLITICAL

Israel killed the Houthis Prime Minister and others in retaliation for missiles fired into Israel. Decapitating the enemy leadership is a key weapon used by Israel to stop attacks.

President Trump sent more warships to the coast of Venezuela to intercede drug shipments. A drug ship was destroyed. Another benefit is to keep Venezuela’s drugs out of the U.S. Drug king, President Nicolas Maduro, now fears regime change.

China held a massive military parade during its leaders summit. New weapons were shown. Now called the ‘CRINKS” – the China-Russia-Iran-North Korea alignment against the US, they were very belligerent against US attempts at secondary sanctions and continuing to be the global policeman. New intercontinental ballistic missiles, unmanned tanks, stealth drones and nuclear weapons were shown. China now has first class weapon systems, the largest military manpower and the world’s largest navy. Will they go after Taiwan during the Trump administration?

Russia showed off its jamming techniques by firing an EMP that forced the EU’s leader to lose GPS in Bulgaria. The US showed off an EMP capability to neutralize drone swarms (defense contractor Epirus).

3. ENERGY

OPEC meets this coming Sunday and plans to announce additional production quotas’.

Germany is interested in buying Canadian LNG. This would be done by contracting for LNG on the west coast and then swapping them with Asian buyers for deliveries in Germany. Both could save transportation costs.

China continues to buy Russian and Iranian crude as it adds to its Strategic Reserves (SPR) at current low prices.

India also loves Russian imports which trade US$3-4/b cheaper than Brent. Both countries have no intention of stopping due to US secondary sanctions.

Syria has initiated crude exports after 14 years. It shipped its first cargo from its Tartus terminal on its west coast. The crude comes from Kurdish areas of the country that had US forces keep former President Assad from gaining access to the revenues from oil sales.

China struck a deal with Russia to build a large natural gas pipeline from Siberia through Mongolia to NE China. The new line called the Siberia 2 pipeline would meet 20% of China’s needs and offset 70% of the volumes Russia lost to Europe. China got a very good deal on the price and will fund the construction.

The CEO of TransMountain said no new crude pipelines are needed at this time as they can lift their capacity from 890,000 b/d (now using 730,000) as it adds compression and chemical additives to move more crude. They see boosting capacity to 1.0 Mb/d. However given long lead times, more capacity (new pipelines) will be needed by 2030.

I remain concerned that other Geopolitical Challenges could take place and be the ‘Black Swan’ to take the general stock markets to our downside targets.

Our expected downside targets are:

Dow Jones Industrials Index 35,000 (now 45,461)

S&P 500 4,800 now (now 6,475)

NASDAQ 15,000 (now 21,578)

S&P/TSX Energy Index 230 (now 277)

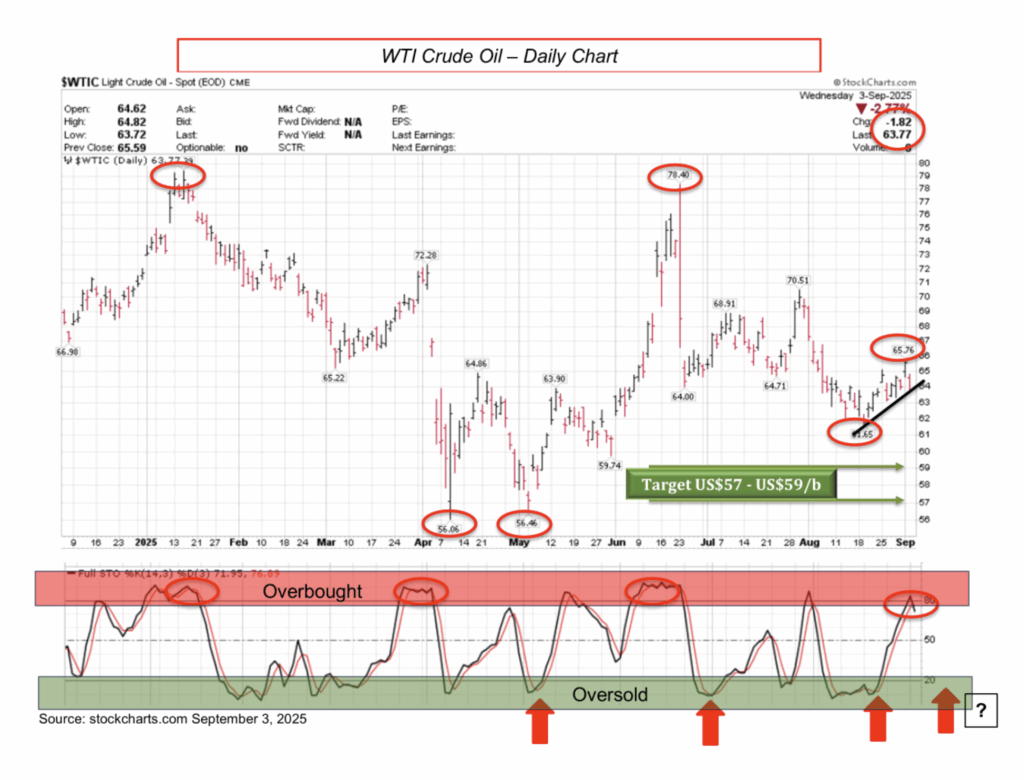

WTI US$57-59/b (now US$63.44/b)

We see WTI rising after the current dip and the potential issues that could drive prices quite high in coming years are:

Global growth in late 2025 and from 2026 thereon should exceed global supplies.

Lack of production growth from most of the non-OPEC world.

OPEC production nearing effective capacity versus published potential capacity.

US crude production levels are not growing as they have in the past.

If you want to see our Action Alert BUYS and our ongoing research on 33 companies in the energy sector then please sign up now for access to the Schachter Energy Research reports.

BULLISH PRESSURE

1. US Tariffs on imports would raise prices for consumers and businesses. We now need to wait for upcoming data to see what occurs. Trade will now expand to new countries increasing energy consumption. For example China has nearly doubled its exports to African countries.

2. Non-OPEC supplies are not growing.

3. Some OPEC members have not invested to increase their production so for many members any quota increase is meaningless.

BEARISH PRESSURE

1.Demand weakness in many European OECD economies.

2. OPEC’s continuing additions to the market as they work to regain market share.

3. US and China demand for crude and products is not growing in terms of final demand (excluding their SPR’s which are growing).

4. The US was an exporter of crude 3.88 Mb/d last week.

EIA Weekly Oil Data

The EIA data for last week was negative. Total Stocks rose 7.6 Mb to 1670.5 Mb, Commercial Stocks rose 2.4 Mb to 420.7 Mb while the SPR gained 0.5 Mb to 404.7 Mb. Motor Gasoline Stocks fell 3.8 Mb while Distillate Fuel inventories rose 1.7 Mb. Exports rose 74 Kb/d to 3.88 Mb/d. Refinery Utilization fell 0.3% to 94.3% but is above the level of 93.3% in 2024.

US Production fell 16 Kb/d to 13.4 Mb/d and is up from 2024 levels of 13.3 Mb/d, up 123 Kb/d on the week. Overall product demand fell 962 Kb/d to 20.7 Mb/d, as Motor Gasoline demand fell 123 Kb/d to 9.12 Mb/d. Other Oils demand fell 359 Kb/d to 4.91 Mb/d and Distillate demand fell 373 Kb/d to 3.77 M b/d. Jet fuel consumption fell 26 Kb/d to 1.70 Mb/d. Cushing Inventories rose 1.6 Mb to 24.2 Mb. This level is below the 2024 level of 26.4 Mb.

Overall 2025 US demand is up 0.9% to 20.3 Mb/d up from last year’s 20.1 Mb/d while Gasoline demand is down for the year by 0.6% to 8.80 Mb/d from last year’s 8.85 Mb/d.

In the coming weeks crude prices should decline towards US$60/b as the summer driving season ends. Prices during September/October should see a decline below US$60/b towards the US$57 – US$59/b area. Recently WTI got overbought and has rolled over as can be seen from the chart below. We expect to get our next BUY signal at that time. In Q4/25 crude prices should lift to the US$72 – US$76/b level. Energy related stocks should be great performers as global demand picks up when winter starts.

EIA Weekly Natural Gas Data

Last week there was an injection of 18 Bcf (data August 22nd). This raised storage to 3.22 Tcf with the biggest increase coming in the Midwest with injection of 20 Bcf. There was a draw from South Central of 16 Bcf. NYMEX is now at US$3.08/mcf. In 2024 there was a 35 Bcf injection and for the five-year average, injection was also 35 Bcf. US Storage is now 3.4% below last year’s level of 3.33 Tcf and 5.0 above the five year average of 3.06 Tcf. US power usage is at a record high this year according to the EIA. Demand is forecast to grow materially as data centre demand and home and businesses use more natural gas in the coming years. LNG exports have risen to 15.9 Bcf/d in August from 15.6 Bcf/d in July. Plaquemines LNG (the second largest LNG plant in the US) is now moving 3.2 Bcf/d, now 20% of US LNG. More production is expected in the coming months as it has received FERC approvals. Not bad for a greenfield project producing just three years after receiving first approval. Crazy time line difference in Canada.

We recommend buying the very depressed natural gas stocks during periods of market weakness. Many natural gas stocks are very cheap now. We see much, much higher gas prices in Q4/25 as quite a number of new LNG plants come onstream over the next 12 months.

Demand for natural gas for data centres is rising quickly as more facilities come on stream and local utilities are providing the power via solar or gas fired facilities. The spending by Big Tech is higher now for data centers versus for Telecom in the late 90’s.

AECO is trading around C$0.80/mcf, due to the slower than expected ramp up of LNG Canada Train 1 facilities, pipeline and facility maintenance holding back 1 Bcf/d of exports and full Canadian storage levels. In September the maintenance issues will be completed and full volumes will be able to be moved via pipelines. In addition, once regular operations are reached at LNG Canada then one export cargo can be loaded every two days. We look for AECO to rise to over C$3.00/mcf during Q4/25 and over C$3.50/mcf during winter 2025-2026. Operators can hedge all of their 2026 production now at >C$3.00/mcf. Higher prices should come as more LNG plants are planned for the BC coast.

European natural gas prices are around US$13/mcf (versus US$12/mcf in Asia) as storage is depleting quite quickly. European inventories are low for this time of year’s stock rebuild. Rebuilding storage to the required 90% level by November 1st for winter 2025-2026 will be a big challenge across Europe and should keep import prices high. Europe is now 76% full, putting them on track to meet the legally required level of 90% by November 1st, to prevent shortages during winter. One problem spot is in Germany where its largest facility in Rehden is only at 23% full compared to a goal of 45% before winter hits. The shortfall is due to seasonal maintenance coming from Norway, one of their largest suppliers.

Catch the Energy Conference

Registration is Open – Join Industry Leaders at the Catch the Energy Conference!

Tickets are now on sale for the public. Become a subscriber and get two free tickets to the conference (tickets to the public are on sale at $119 per ticket each during the early bird window until September 20th (they then move to $179 each). To find out more go to www.catchtheenergyconference.com . We did sell out last year so if you would like to attend please get your tickets as soon as possible.

As usual SER subscribers will receive two complimentary tickets to the event. We look forward to seeing you there!

We are working away on getting our Presenters for this year’s conference. Below are those already signed up with confirmation forms in. We have met with other companies and will update this list as their confirmations come in. We have room for 45 companies and there are some slots still available. SER subscribers always get two complimentary tickets so please put the event in your calendar for October 18, 2025 if you can come to Calgary.

If you know of any companies with great stories and are public companies then have them reach out to me and we can meet them and see if the company would resonate with our attendees. We expect to have over 800 attendees this year versus just over 700 last year. My contact information is josef@sersinc.ca.

Last week we signed up Frontier Lithium (FL-V) and Volatus Aerospace Inc. (FLT-V) adding to the TMX critical minerals line-up.

Thank you to our Sponsors, Exhibitors and Presenters. It is going to be a great lineup and largest attendance this year!

Baker Hughes Rig Data

In the data for the week ending August 29th, the US rig count saw a decline of two rigs to 536 rigs working. US Rig activity is now 8.1% below the level of 583 rigs working last year. Of the total US rigs working last week, 412 were drilling for oil and this is 14.7% below last year’s level of 483 rigs working. The natural gas rig count is up 25.3% from last year’s 95 rigs, now at 119 rigs as wells are drilled to meet LNG export requirements and data centre power requirements. Companies remain financially disciplined despite the Trump administration edict to ‘drill baby drill’. WTI will need to exceed US$80/b for some time before drilling activity picks up materially for crude production to reach new all time highs. Natural gas needs to be over US$4.00 for NYMEX to incentivize natural gas drilling activity on a consistent basis. President Trump is in glee over the lower price of crude and lower gasoline prices during the Labor Day long weekend (one of his election promises).

In Canada, there was a 5 rig decrease to 175 rigs. This rig activity rate is now down 20.4% compared to last year’s 220 rigs. There were 120 rigs drilling for oil last week down 21.5% from 153 last year. Drilling for natural gas was down 17.9% from 67 rigs to 55 rigs this week due to low and unprofitable natural gas prices.

Energy Stock Market

The S&P/TSX Energy Index today is at 27x. I still expect a 10 -15% correction in the Index.

We like to BUY when stocks are cheap and being ignored. Bargains are clearly being seen now. Late October should provide the next great window to add to favourite positions at prices 10% lower than today. Investors should decide what you want your energy weighting to be for this long energy super cycle. Our BUY List includes ideas from the Royalty area, Canadian oil and natural gas ideas, energy service ideas and companies working internationally. Our list includes large Conservative ideas and small to large caps in our Growth and Entrepreneurial categories. Add to your current ideas or add new ideas. We expect global demand should exceed supplies at that time. We see WTI prices above US$75/b consistently during 2026.

Our next SER Monthly comes out to paid SER subscribers on September 11th. It will include the Q2/25 results of the last 12 companies that we cover. If you are interested in independent analysis of the energy sector and to see our Balance of Evidence sections on the individual companies then become a subscriber. https://schachterenergyreport.ca/subscriptions/

I will be on with Michael Campbell and his MoneyTalks webcast on Saturday September 27th. With all of the movements in energy prices and the geopolitical issues impacting prices it should be a memorable discussion with Mike.

CONCLUSION

Down market days for energy stocks are the best days to build your positions for the lengthy energy super cycle we see lasting into the end of the decade. Subscribe now so you don't miss it!

We see energy having a very rewarding period for investors into year end from upcoming lows. Some of the BUY ideas we show on our SER Recommendation List could see upside of 50% or more into year end if our call of over US$75/b occurs.