Report Navigation

Free Previews are abridged to help users get a feel for Josef’s newsletter and the topics it contains. The navigation below is deactivated, and excerpted sample content has been added below. Full content is available to subscribers – subscribe today!

1. Market & Energy Update

WTI Fell into predicted BUY Range.

2. Company Update

SER Action Alert BUYS Released March 5, 2025.

3. Quarterly Reports

Start of Q4/24 Reporting Cycle - 11 Companies.

4. Top Picks Now

Five Ideas Trading At Very Attractive Valuations.

5. Company Lists

Covered Companies & Valuation Analysis. Company Links.

6. Action Alert Lists

Action Alert Performance Reports, & Action Sell Lists.

7. Disclosure List

SERSI & Family/Staff Ownership Disclosure.

Welcoming Comments

The cut-off date for this SER report’s data was Wednesday March 5, 2025.

Josef Schachter

@lysle_photography

Tariffs on, then tariffs off or reduced and the stock markets have gyrated with every change in direction from President Trump. To keep up with ramifications for the energy sector please read our weekly ‘Eye On Energy’ for our thoughts. The tariff war is moving quickly so our weekly Eye report is the best read to cover this important issue.

The Dow peaked at 45,100 in late January and fell last Wednesday March 5th to 42,400. With March 12th being the date for tariffs on aluminum and steel that would hurt Quebec and Ontario followed by April 2nd worldwide countervailing tariffs, we are in a period of nasty markets for a few weeks due to the uncertainty. Markets and investors hate uncertainty. I see downside risk on the Dow to the 38,000 level if the nastiness continues.

Canadians are taking this tariff battle in stride and nationalistic pride is gaining support. Going to stores to shop means checking labels carefully and ‘Made In Canada’ is becoming more popular. It will be interesting to see if the strife continues and if U.S. goods remain on shelves or store operators remove items and put Canadian products up instead. Ontario liquor stores have already removed US products from their shelves.

Last week we got one of our BUY signals triggered. The price of WTI fell below our target of the US$66-US$68/b level. In fact, it spiked down to US$65.22/b so on March 5th we issued an SER Action Alert with three new BUY ideas and re-iterated three previous BUYS that had fallen to bargain levels. The other two key indicators are also getting close to triggering BUY signals. If we get one more Buy signal triggered that would reinforce the confidence of a low risk BUY situation. If we are fortunate to get both other signals saying BUY, then we will be in a Table Pounding BUY situation. The last time that happened was in March/April 2020. From those multiple BUY signals, we had a wonderful market with many energy stocks rising five times or more over the next two years. I think getting all three signals triggered over the coming weeks as a high probability.

This issue starts the run of Q4/24 and annual 2024 results. We have 11 companies reviewed in this issue and over the next two issues we should have all 39 covered companies reviewed.

In this issue’s TOP PICKS NOW section, we have five bargain-priced energy stocks for you to consider. Even though we see some more weakness in the next few weeks for the energy sector, not all stocks peak or bottom at the same time. The recommended TOP PICKS NOW are all trading at very cheap valuations area and have retreated materially from their summer highs.

Josef Schachter

We have also added some additional names to watch closely as they may retreat during the upcoming correction. You may find some great ideas there to add to your portfolios during the next period of market upheaval.

There were two great buying windows in 2H/24. One was on September 10th when we got a BUY signal when crude fell below US$68/b, and we added five new BUY ideas. The next was during the nasty tax loss selling season during the first three weeks of December. I hope you took advantage of the bargains that developed during that window.

We got a new BUY signal last week. If we get one more BUY signal triggered and we add some more new BUY ideas to our SER Recommended BUY List we will recommend investors take their energy weighting to whatever they consider a ‘full’ weighting. We intend to commit our reserves at that time and become ‘fully’ invested. Please talk to your investment advisor to decide what is appropriate for your specific accounts.

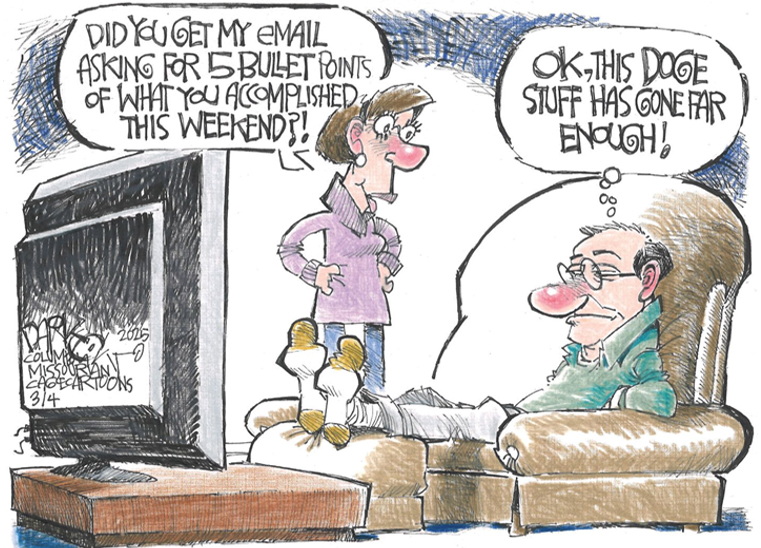

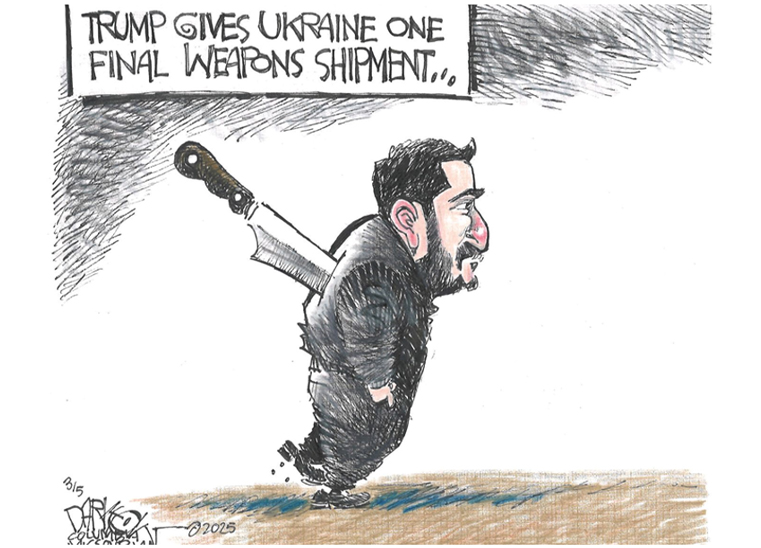

For Your Amusement

Challenging Issues

Source: theweek.com, March 2025

To Buy or Not to Buy

| VALUE | + | SENTIMENT | + | TECHNICALS | = | OVERALL |

|---|---|---|---|---|---|---|

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

Green Light to Buy

Cheap valuations, Sentiment not bullish, Technicals very attractive

Yellow Light for Caution

Some wavering on parameters, or parameters not clear. Some stocks may be attractive, others not so

Red Light to Stop or Sell

Parameters bearish, stay away, sell down, warning to wait for the next buy signal

Click here to launch the Research Process in another tab for detailed definitions and checklist items

1. Energy & Stock Market Overview

WTI fell into our BUY range that we have been predicting for some time, falling below US$68/b. In fact, it fell below US$66/b which was our downside case. In Chart #1, on the bottom of the charts you can see the ‘Oversold’ levels and we now have a new one. Notice in 2021, the downside just reached the top of the oversold level while at other bottoms it went deep into the bottom of the range. We have had sufficient price decline for crude, but we may see some backing and filling over the next 3-5 weeks. This would take the ‘Oversold’ even lower which would be very supportive to our view.

The second indicator to keep an eye on is the actual level of the S&P/TSX Energy Index. It fell to 240 last week and our BUY signal kicks in <240 (range 235-240) Chart #2. Note the oversold levels for the four BUY signals over the period from 2023. The current signal is quite deep into the ‘Oversold’ level so one more strong market decline should trigger a BUY from this indicator.

Thumbnail screenshots of report charts

Charts in the subscriber newsletter are full sized with additional context. Thumbnails shown here only for reference.

Our favourite indicator which has a high reliability record is the S&P Energy Bullish Percent Index. When over 90% it highlights an overbought market and signals to take profits or sell if at long-term price targets. At <10% it signals BUY and below 5% it signals a ‘Table Pounding BUY’.

In Chart #3 on the right side it shows that this indicator was at 62% in mid-February and in just a few weeks it has declined to 27%. Note it is below the 29% in early 2025 and is just above the 23% seen in August 2024. The speed of the recent decline is like previous large plunges which were followed by <10% data. In Chart #4, you can see five instances where the Index fell below 10% and three of which fell even further to below 5%. The lowest reading in recent years was in March 2020 at 3.7% bullishness. This was a wonderful BUY signal that in the following two years many stocks went up five times and many of the market darlings went up over 10X. Just check any of your favourite energy stocks against these signals and you can easily see how important and lucrative they are.

I think we have a good chance of a decline below 10% in the next few weeks which, historically, has meant many energy stocks could double in the next two years. If we see a number below 5% then it would justify a ‘Table Pounding’ BUY signal that would be a joy to be invested for and see even better upside targets.

If we get all three BUY signals triggered, subscribers should talk to their investment advisors and decide what names fit their investment goals. We will be recommending going to whatever a ‘full weighting’ is for each subscriber. Personally, we are doing this ourselves and this will be reflected in upcoming SER Ownership pages in our Lists section of the SER report.

3. Company update

On March 5, 2025, we circulated an Action Alert concerning six ideas. We added five new investment ideas today and reiterated BUYS on three ideas on the current BUY List that are at bargain levels.

The Schachter Energy Report Covered Companies are part of a proprietary subscribers-only list, and so is not available in the free preview. Time sensitive Action Alerts on table-pounding BUYs are a main feature of a Schachter Energy Report subscription.

4. Quarterly Updates

The Schachter Energy Report has a proprietary list of over thirty oil & gas companies. These companies have landing pages with detailed financial information and a history of posts, including Action Alerts for BUY or SELL opportunities, and Quarterly Reports.

Each quarter, Josef covers the investment communications and public updates of each of his covered companies.

In this March 2025 issue, Josef covered the first eleven Q4/2024 Reports. At left is a redacted example of one such Quarterly Update, covering financial updates, overview, Balance of Evidence, selected Investor Communication Slides, annual Net Asset Value review, Weekly and Monthly charts highlighting BUY ranges and estimated peak market value, and a final conclusion setting the stage for upcoming Action Alerts.

The Schachter Energy Report Covered Companies are part of a proprietary subscribers-only list, and so is not available in the free preview. Quarterly Reports for each covered company are a main feature of a Schachter Energy Report subscription.

5. TOP PICKS NOW

For those seeking more issue-to-issue advice on investments, The Schachter Energy Report also includes a Top Picks Now list, featuring ideas from:

- Pipelines, Royalties, and Infrastructure

- Domestic Liquids Companies

- Domestic Natural Gas Companies

- International E&P Companies

- Energy Service Companies

At left is a redacted example of one such Top Picks Now, which suggested five companies and gave an overview of other ideas available and at what level to act. Some issues Josef recommends ideas in every category – but not every issue. The Schachter Energy Report prides itself on informed, not obligated, advice.

The Schachter Energy Report Top Picks Now List is part of a proprietary subscribers-only list, and so is not available in the free preview. Top Picks are a main feature of a Schachter Energy Report subscription.

5 - 7. Lists

For those seeking more issue-to-issue advice on investments, The Schachter Energy Report also includes a Top Picks Now list, featuring ideas from:

- Coverage List

- Valuation List

- Action Alert BUY List

- Action Alert SELL List

- Disclosure List

Below are redacted examples of these Lists. Covered Companies are a proprietary subscribers-only list, and so are not available in the free preview. Analysis Lists are a main feature of a Schachter Energy Report subscription.

Charts in the subscriber newsletter are full sized with additional context. Thumbnails shown here only for reference.

Company coverage list

Valuation

list

Action Alert performance

Action Alert performance

Disclosure chart