Global Economic, Political & Military Update

The stock markets continue to have positive momentum as AI stocks and the tech sector in general, continue to extend these overbought areas. This week Central Banks have meetings and the market expects no change in rates but wants to see the forecasts/guidance for 2024. For the US, the Fed’s dot plot today indicated 80 BP of cuts (three rate cuts) in 2024 still below the market’s view of 100-125 BP of cuts in 2024. The Fed plans to continue to lower their balance sheet so some tightening will continue from this action. The stock market liked the Fed announcement and has bounced upward again as rate increases now seem to be not part of the Fed’s plans. We do not expect to see Fed Funds rate cuts at the January, March or even May meetings, so any cuts would likely be in 2H/24 if the data supports such a move. This would require a softer jobs market (labour force excess) and lower inflation data. Such is not the case now.

Some of the noteworthy economic data to consider for the mixed picture for the bulls and the bears are:

- The November US jobs data (reported last Friday) was robust and beat expectations. Jobs grew by 199k (180 K forecast) and included 41K from returning autoworkers and actors as their strikes ended. Job gains were seen in health care (77K), and government (49K). Average hourly earnings rose 0.4% during the month and were up 4.0% year over year. The unemployment rate fell to 3.7% from 3.9%. This data is not supportive of the Fed changing its course.

- US Core CPI rose 4.0% in November. The big contributor to the better number was lower energy costs (gasoline fell 6% during the month and was down 8.9% from last year). The base CPI number rose 3.1% down from 3.2% in October. Core CPI services rose 4.6% (medical care rose 0.6% in the month). Core CPI shows the stubborn price increases are not abating. PPI out today came in flat as lower energy prices held this number down. If we are right about higher energy prices in 2H/24 then the inflation data will reverse their downward trend. We are in a stagflation environment.

- Money market funds in the US continue to see large inflows as investors want to secure high safe returns. Inflows were US$62B last week to reach fund assets of US$5.9T.

- China is facing deflation as their CPI fell 0.5% in November. Consumers are spending less as export industries are hurting. In addition real estate companies remain in trouble and more are going bankrupt harming their investors who bought properties that will not be completed and the buyers have lost their large deposits.

On the two wars fronts:

- The US Embassy in Baghdad was attacked by two salvos of rockets last Friday by Iranian proxies. The US has not retaliated yet. Iran is pushing the limits of US patience and so far, outside of retaliation against the proxies, there has been minimal US response. They will likely continue to push the limits of US tolerance.

- Yemen’s Houthis supported by Iran have attacked a tanker with missiles as it navigated the Red Sea. The US is now working with allies to escort ships around the Gulf Of Aden.

- Israel has closed its port of Eilat as a result of the shipping difficulties.

- To get at the Hamas terrorists Israel is now pumping Mediterranean sea water into selective tunnel areas in Gaza to force the fighters to surrender and destroy the underground infrastructure.

- President Zelensky is in Washington this week to get Congress to approve more funding for them to continue to oppose Russia. The Democrats are onside with support as is the President. However, Republicans in the House remain adamant that President Biden agree to fund US border security and to expedite deportations of illegal migrants. In addition, for the long term they want stricter asylum standards.

- No deal for more funds and munitions and weapons for Ukraine will likely end their offensive actions. This will put the fighting in a WW1 bunker defensive posture. The Ukrainian major counter offensive now looks to have gained little for the huge cost of manpower and munitions.

- Putin is playing a long defensive game with attacks across all the borders with Ukraine as he wants to drag the war into late 2024 and gamble that his friend Trump will become President again and work out a diplomatic solution that ends in Russia’s favour.

Market Update: We continue to expect general stock market weakness as it is extremely overbought. Once the correction has lowered overall stock prices and fear has returned to the markets, be ready to buy the bargains that develop in other sectors of the markets. Energy has capitulated as WTI breached US$70/b. With many energy stocks down significantly from their October 2023 highs, and many trading around Proved Developed Producing (PDP) Reserve valuations levels there are some great bargains out there now. If you want to see what our subscribers are looking at, sign up now for access to the Schachter Energy Research reports.

BULLISH PRESSURE

Remember the official OPEC announcements have nothing to do with real production cuts. Rhetorical barrels versus actual barrels. Official announced cuts have been 2.2 Mb/d but real cuts have been only 352 Kb/d as we discuss in our OPEC section below’.

The COP28 meeting is over in Dubai and the final announcement committed to ‘transition away’ from all fossil fuels for the first time. The deal includes provisions to use low-carbon fuels like natural gas as the shift to cleaner energy occurs. The deal includes a goal of tripling the world’s renewable energy capacity by 2030. Stricter language was not supported. Bottom line, crude oil and natural gas will be used for decades to come. While OECD countries may see a decline in crude consumption by the end of this decade with especially large declines in coal, the rest of the world should see energy growth in excess of the OECD decline. There were no firm targets agreed to. So far none of the stretch goals of these meetings have been met as China and India (with the largest populations) keep on adding to their coal fired electricity capacity.

We see consumption of crude this year at 101.0 Mb/d and at 102.4 Mb/d in 2024. By 2030 world demand for crude should be over 108 Mb/d and the industry is not spending enough to provide this capacity. Higher energy prices will be needed to attract the capital to grow capex.

BEARISH PRESSURE

Our expectation that WTI crude prices would decline and reach US$70-US$73/b this month has now occurred. The probe below US$70/b has set up a bottoming process. WTI fell today to an intra-day low of US$67.71/b. Use periods of market weakness to build up your energy weightings.

EIA Weekly Oil Data

The EIA data (data cut-off December 8th) was mixed for crude prices. Commercial Crude Stocks fell 4.3 Mb to 440.8 Mb but are up 16.6 Mb above last year’s levels. The SPR saw no change on the week. Motor Gasoline inventories rose 0.4 Mb. Refinery activity fell 0.3% to 90.2% from 90.5% last week. It is down from 92.2%, last year at this time. Distillate Fuels saw a rise of 1.5 Mb/d. US crude production remained flat at 13.1 Mb/d. Production in 2023 is up 1.0 Mb/d from year ago levels, as longer reach horizontal wells with improved fracking procedures and more sand, are producing more crude. Cushing inventories rose 1.2 Mb to 30.8 Mb and up from 24.4 Mb a year ago. US product inventories are sufficient to meet winter 2023-2024 needs. The national average for unleaded gas was US$3.14 per gallon on December 12th. That is 23 cents below a month ago and the lowest price in a year.

Seasonal winter demand is lifting US consumption. Last week Motor Gasoline consumption rose 394 Kb/d to 8.86 Mb/d. Jet Fuel saw a rise of 454 Kb/d to 1.87 Mb/d. Total Demand rose 1,468 Kb/d to 21.08 Mb/d due to the above consumption increases and as well that Other Oil demand grew by 408 Kb/d to 5.14 Mb/d. Total US consumption is below last year on a year-to-date basis by 0.5%. Consumption was at 20.17 Mb/d versus 20.28 Mb/d last year.

OPEC Monthly Report

The December 2023 report released today showed that in November OPEC saw a modest decrease in production of 57 Kb/d to 27.8 Mb/d as Iraq saw a decline of 77 Kb/d to 4.28 Mb/d and Angola saw a decline of 37 Kb/d to 1.13 Mb/d. This was offset by increases by Venezuela of 23 Kb/d to 780 Kb/d, by Libya of 21 Kb/d to 1.18 Mb/d and Saudi Arabia that increased production by 12 Kb/d to 9.0 Mb/d. So far total OPEC cuts since the start of cutbacks in July 2023 have been only 352 Kb/d (June 2023 production at 28.2 Mb/d to November’s 27.8 Mb/d of production) and are far away from the stated cut of 1.2 Mb/d by OPEC and the cut of 1.0 Mb/d by Saudi Arabia. So while cutbacks in production, they are not the 2.2 Mb/d cuts that were announced. Of note US production increases have more than offset the real OPEC cuts by a large margin.

The market is ignoring the actual production data and is listening to the OPEC pronouncements and their gadflies. The recent trial balloon of keeping the 2.2 Mb/d cuts into the end of Q1/24 and maybe into the end of 2024, has not lifted crude prices.

EIA Weekly Natural Gas Data

The EIA data released last Thursday December 7th was supportive of natural gas prices as it showed a withdrawal of 117 Bcf for the week ending December 1st. Storage is now at 3.72 Tcf. The biggest decline was in the South Central area (32 Bcf). This compares to the five-year withdrawal of 67 Bcf and the 2022 withdrawal of 50 Bcf. US Storage is now 7.3% above last year’s level of 3.47 Tcf and 6.7% above the five year average of 3.49 Tcf. NYMEX is today priced at US$2.33/mcf as the weather is above normal this week for this time of year.

Our forecast is for NYMEX to rise above US$3.50/mcf as cooler winter weather arrives. NYMEX should spike over US$4.50/mcf during the coldest days of winter 2023-2024. Europe should see tightened supplies this winter as well as colder weather has arrived earlier than in North America.

We recommend buying the very depressed natural gas stocks during periods of general market weakness. We intend to add additional natural gas names to our Action BUY list when we get the next low risk energy BUY signal.

Baker Hughes Rig Data

In the data for the week ending December 8th the US rig count rose one rig to 626 rigs (up three rigs last week). Rig activity is now 20% below the level of 780 in 2022. Of the total rigs working last week, 503 were drilling for oil and this is 20% below last year’s level of 625 rigs working. The natural gas rig count is down 22% from last year’s 153 rigs, now at 119 rigs. The natural gas focused Haynesville now has 42 rigs working down from 69 rigs working last year or down by 39%.

In Canada, there was a two rig increase to 192 rigs (down five rigs last week). Canadian activity is down 4% from last year when 202 rigs were working. Activity for oil is down 8% to 120 rigs compared to 131 last year. Activity for natural gas is up 4% at 74 rigs up from 71 last year. The main focus on natural gas drilling has been on the liquids rich condensate Montney and Duvernay plays.

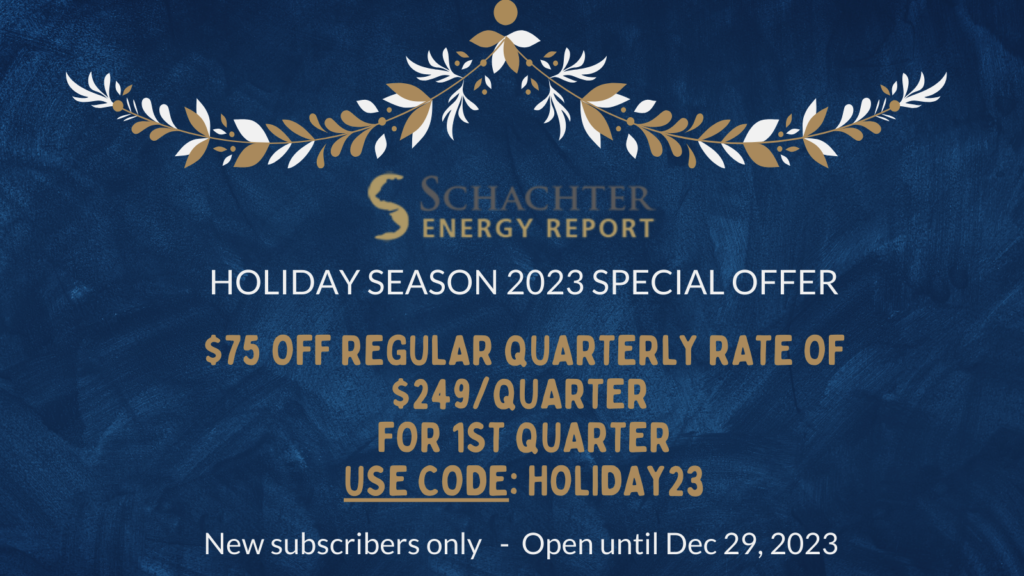

This holiday season we are offering a special deal of $75 off the regular quarterly rate of $249. Just use code: Holiday23 at checkout. https://schachterenergyreport.ca/subscriptions/

Energy Stock Market

The S&P/TSX Energy Index today is at 235, down 7 points from last week as WTI trades down at US$69.35/b (intraday low US$67.71/b). We expect the S&P/TSX Energy Index to fall below 230 shortly, and could reach 220 for a spike bottom. We are close to triggering another BUY signal.

Last week Thursday one of our three key BUY signals triggered (crude price decline below US$70/b) and we sent out an Action Alert with seven new investment BUY ideas for subscribers to consider. A second signal is likely to trigger in the coming days and we plan to add four or five additional investment BUY ideas. If you want access to this information please become a subscriber and take advantage of our holiday special offer.

Investors should decide what you want your energy weighting to be for this long energy super cycle. Our BUY List includes ideas from the Pipeline & Infrastructure area, Canadian oil and natural gas ideas, energy service ideas and companies working internationally. Our list includes large Conservative ideas and small to large caps in our Growth and Entrepreneurial categories. Add to your current ideas or add new ideas. We expect that WTI should lift above US$90/b in 2H/24 as winter 2024-2025 demand should exceed supplies at that time and we see recovering economies globally.

CONCLUSION

WTI is priced today at US$69.35/b. We expect to take advantage of the bargains in energy stock prices with new BUY ideas shortly if one more of our BUY signals is triggered. Additional Action BUY Alerts are likely in the coming days. Down market days for energy stocks are the best days to build your positions for the lengthy energy super cycle we see lasting into the end of the decade.