Global Economic, Political & Military Update

The stock and bond markets continue to have positive momentum with the traditional seasonal holiday rally mode underway. There are a lot of excesses in both markets but for now investors are ignoring the negatives. Institutions have closed their books for the year so retail investors can move stocks given the low volumes until we get into 2024 trading. An example, Fedex (FDX-N) is down today by over 10% (or down US$28.74 per share to US$251.25) due to slower volumes and revenues. This hit is more than should have been seen when institutions are having normal investment days.

The big item being watched is the Red Sea where the Iranian backed Houthis have attacked shipping. A crude tanker heading to Israel was attacked and any ships that are owned by Israelis are also on the hit list. Shipping operated by Arab countries (Iraq, Iran and Qatar) are being left alone, as are those of Iran’s friend Russia. Russia is now shipping 1.7 Mb/d via the Red Sea to Asian buyers versus under 200 Kb/d before the invasion of Ukraine. As ships are diverted around the African coast, it adds 18 days and 5,500 miles to their travel time. For those still using the Red Sea, insurance rates have skyrocketed. Overall in just a week the price of WTI has lifted US$6.85/b (from US$67.71/b to US$74.56/b). Today’s intraday high was US$75.37/b. We see this as temporary as the US and allies have moved 43 warships into the area to escort shipping and shoot down any missiles or drones fired by the Iranian proxies at the commercial ships. More ships have been allocated to come if the current level of warships are insufficient. US and allies have pledged to increase warships into the area by 50 more if needed (some already en route). The area needing to be patrolled is the Bab el-Mandeb chokepoint which sees 8% of the world’s energy supplies shuttled through daily. This US Navy led operation has been called ‘Operation Prosperity Guardian’. So far no retaliatory action against the Houthis has occurred but if it did then Iran will have been put on notice that they could be next.

It is quiet on the economic front as the holiday season is underway but a few releases are of note:

- US Retail Sales continue to hold up. In November they rose 0.3% versus an expected decline of 0.1%. Excluding gasoline (which fell in 3% price) sales rose 0.6%.

- More countries in the third world are facing defaults on their debts. Ghana, Zambia and Sri Lanka have defaulted and Ethiopia is expected to default in the New Year. This adds to the travails of the IMF and World Bank.

- Chinese banks are speeding up bad loan sales as they try to strengthen their balance sheets. Large losses are occurring. China’s slow move to shift their economy from a construction and export one to a domestic consumption driven one has come home to roost. Debt growth has outpaced economic growth over the last decade and now local governments and real estate firms are struggling. The Chinese stock markets continue to fall to new lows for 2023.

- The US House of Representatives have gone home for the holidays so no deal to fund the border or Ukraine can happen before year end. Once back in early 2024 this will become more contentious as 2024 is a Presidential election year. Bipartisanship is hard to get when the sides are so polarized and wanting to gain power across the board (Presidency, the Senate and the House). The last election in 2020 was very close and very contentious. This one could be much more and potentially violent as well.

On the two wars fronts:

- Ukraine is running out of munitions and funds to continue its counteroffensive. They are now scaling back operations and have increased conscription. They are in a box as the US$60B aid package is stalled into the New Year (if even agreed to in Q1/24) and Hungary has blocked (with its veto) the US$54.5B in 2024 EU funding. This is providing some respite to Russia and giving them time to increase their weaponry and manpower in the invasion front lines.

- Israeli hackers have made a major cyberattack against 70% of Iran’s gas stations as a warning that they can be hit economically due to their sponsorship of terrorist proxies.

Market Update: We expect general stock market weakness in early 2024 as they are extremely overbought. Over the last two weeks since our BUY recommendation (December 7th) energy stocks have had a very nice bounce. However, if the general stock market retreats over the coming weeks then energy stocks, which are high beta, will test the lows of earlier this month. When that happens be ready to buy the bargains that develop across all markets. If you want to see what our subscribers are looking at, sign up now for access to the Schachter Energy Research reports.

BULLISH PRESSURE

We see consumption of crude in 2023 at 101.0 Mb/d and at 102.4 Mb/d in 2024. By 2030 world demand for crude should be over 108 Mb/d and the industry is not spending enough to provide this capacity. Higher energy prices will be needed to attract the capital to grow capex despite hawkish anti-fossil fuel moves from most of the OECD countries, including of course Canada. Remember the growth in consumption of crude oil and natural gas will be coming from the emerging world (particularly China and India) as they lower their addiction to coal usage to meet electricity demand and clean up their air quality.

BEARISH PRESSURE

Our expectation that WTI crude prices would decline below US$70/b this month has occurred. WTI fell earlier this month to an intra-day low of US$67.71/b. We expect the price of crude to be in a trading range for the next one or two months with a range of US$66-US$76/b. Use periods of market and energy price weakness to build up your energy weightings.

EIA Weekly Oil Data

The EIA data (data cut-off December 15th) was negative for crude prices. Commercial Crude Stocks rose 2.9 Mb to 443.7 Mb and are 25.4 Mb above last year’s levels. The SPR saw a build of 600 Kb/d to 352.5 Mb. Motor Gasoline inventories rose 2.7 Mb. Refinery activity rose 2.2% to 92.4% from 90.2% last week. Distillate Fuels saw a rise of 1.5 Mb/d to 115.0 Mb. US crude production rose 200 Kb/d to a new yearly high of 13.3 Mb/d. Production in 2023 is up 1.2 Mb/d from year ago levels, as longer reach horizontal wells with improved fracking procedures and more sand, are producing more crude. Another near term negative was that Cushing inventories rose 1.7 Mb to 32.5 Mb and up from 25.2 Mb a year ago. US product inventories are sufficient to meet winter 2023-2024 needs.

Motor Gasoline consumption fell 106 Kb/d last week to 8.75 Mb/d. Jet Fuel saw a decline of 507 Kb/d to 1.37 Mb/d. Total Demand fell 293 Kb/d to 20.79 Mb/d due to the above consumption declines. Total US consumption is below last year on a year-to-date basis by 0.5%. Consumption was at 20.19 Mb/d versus 20.29 Mb/d last year.

EIA Weekly Natural Gas Data

The EIA data released last Thursday December 14th was mixed for natural gas prices as it showed a low withdrawal of 55 Bcf, down from a draw of 117 Bcf in the prior week (due to warmer weather). Storage is now at 3.66 Tcf. The biggest decline was in the Midwest area (27 Bcf). This compares to the five-year withdrawal of 107 Bcf and the 2022 withdrawal of 87 Bcf. US Storage is now 7.2% above last year’s level of 3.42 Tcf and 7.6% above the five year average of 3.40 Tcf. NYMEX is today priced at US$2.52/mcf.

Our forecast is for NYMEX to rise above US$3.50/mcf as very cold winter weather arrives. NYMEX should spike over US$4.50/mcf during the coldest days of winter 2023-2024. Europe should see tightened supplies this winter as well as colder weather has arrived earlier than in North America.

We recommend buying the very depressed natural gas stocks during periods of general market weakness. We intend to add additional natural gas names to our Action BUY list when we get the next low risk energy BUY signal.

Baker Hughes Rig Data

In the data for the week ending December 15th the US rig count fell three rigs to 623 rigs (up one rig last week). Rig activity is now 20% below the level of 776 rigs in 2022. Of the total rigs working last week, 501 were drilling for oil and this is 19% below last year’s level of 620 rigs working. The natural gas rig count is down 23% from last year’s 154 rigs, now at 119 rigs. The natural gas focused Haynesville now has 43 rigs working down from 72 rigs working last year or down by 40%.

In Canada, there was a 9 rig decrease to 185 rigs (up two rigs last week) as the Christmas slowdown period started early. Canadian activity is down 7% from last year when 199 rigs were working. Activity for oil is down 5% to 118 rigs compared to 124 last year. Activity for natural gas is down 11% at 67 rigs versus 75 last year. The main focus on natural gas drilling has been on the liquids rich condensate Montney and Duvernay plays.

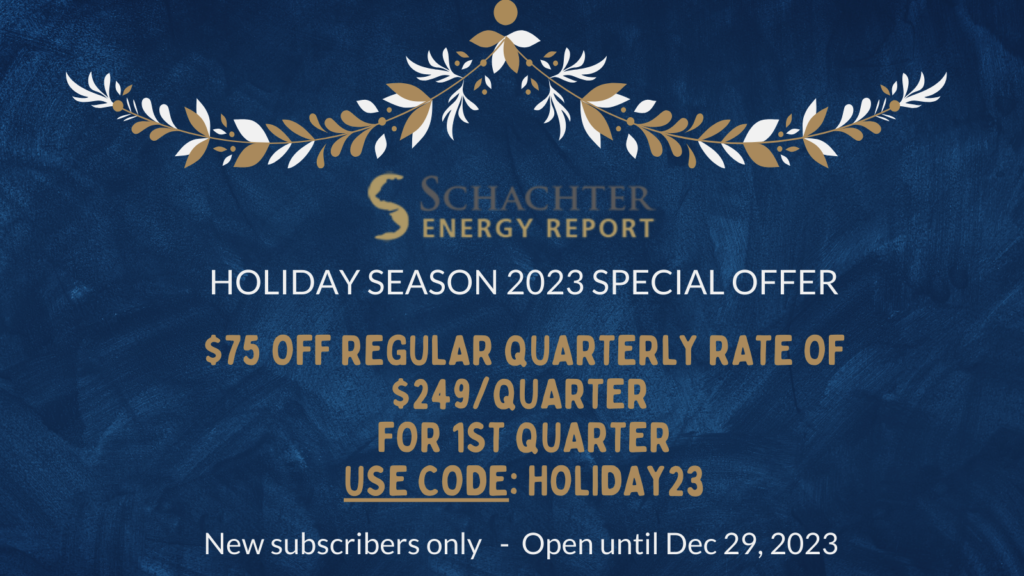

This holiday season we are offering a special deal of $75 off the regular quarterly rate of $249. Just use code: Holiday23 at checkout. https://schachterenergyreport.ca/subscriptions/

Energy Stock Market

The S&P/TSX Energy Index today is at 246, up 11 points from last week as WTI trades up on the Red Sea Houthi shipping attacks. This war premium is expected to erode once the US and allies have their convoy system implemented. If the attacks end then crude will retreat to below US$70/b and provide another low risk BUY window. We expect the S&P/TSX Energy Index to fall below 230, and could reach 220 for a spike bottom.

On December 7th one of our three key BUY signals triggered (crude price decline below US$70/b) and we sent out an Action Alert with seven new investment BUY ideas for subscribers to consider. A second signal is likely to trigger in the coming weeks (after things calm down in the Red Sea) and we plan to add four or five additional investment BUY ideas. If you want access to this information please become a subscriber and take advantage of our holiday special offer.

Investors should decide what you want your energy weighting to be for this long energy super cycle. Our BUY List includes ideas from the Pipeline & Infrastructure area, Canadian oil and natural gas ideas, energy service ideas and companies working internationally. Our list includes large Conservative ideas and small to large caps in our Growth and Entrepreneurial categories. Add to your current ideas or add new ideas. We expect that WTI should lift above US$90/b in 2H/24 as winter 2024-2025 demand should exceed supplies at that time and we see recovering economies globally.

CONCLUSION

WTI is priced today at US$74.56/b. We expect to take advantage of the bargains in energy stock prices with new BUY ideas if one more of our BUY signals is triggered. Additional Action BUY Alerts are likely in the short term. Down market days for energy stocks are the best days to build your positions for the lengthy energy super cycle we see lasting into the end of the decade.