Global Economic, Political & Military Update

Rising and pernicious US inflation now means that the US is unlikely to see a pivot and a cut in rates before the US elections. The Fed’s favourite inflation measure, the core personal consumption expenditure price index (excluding food and energy) increased 3.4% annual rate from a year ago and was much higher than expected. This was a shock as the Q4/23 rate was up 1.8%. Add to that rising labour costs which rose 1.2% in Q1/24 indicate an uptick in wage pressures. With US personal savings at 3.2% there is little room in family budgets to handle higher costs (food, energy, insurance, electricity, etc.). US Consumer confidence fell to a 21 month low in April. The press conference at the end of today’s Fed meeting will be closely watched to see how hawkish the Fed Chairman has become after his more docile comments during his last press conference. One noted pessimist on inflation is Larry Summers and he sees the serious possibility of a rate hike if the inflation data surprises to the upside in the coming months.

The forecast for the April jobs report out on Friday is for an increase of 243K jobs and the unemployment rate to stay flat. Any surprises here could have meaningful market impact.

Recent Treasury issues have not gone well and bond vigilantes are demanding higher yields to purchase the large amount to be auctioned as the Treasury needs to fund this year’s US$2T deficit and refunding requirements. 2-Year US Treasury yields have risen to over 5% (today 5.03%) from 4.4% in early March. Any misadventure with upcoming issues or inflation data would be a depressant for stock markets even more so than the recent decline. In May the Treasury needs to raise US$386B – quite an onslaught of new debt.

Foreign investors in Treasuries are selling aggressively and have been buying gold as they reposition themselves away from the exploding US debt bomb. China sold more than US$74B to hold US$849B and this is their lowest ownership since 2009 (data – US Treasury department). Japan remains the largest US creditor with U$1.17T but they are also now selling to stabilize their plunging Yen.

One item not getting much attention is the rise in interest rates is once again harming smaller US banking institutions. Many regional and smaller banks with large Treasury holdings are nearly insolvent, as rates have reached recent highs. US$6B Republic First Bank of Philadelphia was seized by the FDIC last week. If rates spike above 2023’s highs then this could be cause for the market bubble to burst. That would mean the 2-Year Treasury rising over 5.26% (the October 2023 high) .

On the wars front:

- The failed attack by Iran against Israel and Israel’s muted retaliation has lowered the tension in the area and the war premium for crude has receded. Attacks still occur from Hezbollah into northern Israel and Netanyahu still plans to go after Hamas in Rafah. The US is leading a move to get a small hostage release (maybe 30+) and in return they get a temporary ceasefire to provide food aid to the Gaza civilians. It is good to see that the geopolitical tensions are easing.

- US and other NATO aid is moving to help Ukraine but at a glacial rate according to Ukrainian battle front commanders.

Market Update: The general stock market correction is underway. The Dow Jones Industrials Index peaked in late March at 39,900 and has fallen to 37,916 as we write this report. Our target of 36,000, that we have been writing about for some time, is within reach during this quarter. Having cash and underweight the MEME names (FAANG’s and AI stocks) has helped to not lose as much as the major index.

Energy stocks peaked in early April as crude reached its high of US$88/b on the mideast war premium expansion. The run from early February was very rewarding and the ideas on our SER BUY List for the most part did very well. We see the general market and the energy sector as vulnerable. A moderate correction should occur and that would provide the next low risk BUY signal which we see occurring during Q3/24. The S&P/TSX Energy Index peaked at 308 in week two of April and has fallen today to 288 or down by >6% so far. A downside target below 240 in the coming months is likely. The overbought condition can be confirmed from the S&P Energy Sector Bullish Percent Index which rose from 39% bullish in February 2024 to 91% last week. Over 90% is an overbought reading. Over the last few days of pressure on the sector it has fallen by 8 points to 83%. It should decline below 20% to give off an oversold level and a BUY window once again.

Our new SER issue feature called ‘TOP PICKS NOW’ highlights the best ideas at the time of each SER report. The ideas have worked out very well as not all stocks rise and peak at the same time nor do they bottom at the same time. If you want to see what our subscribers are looking at, sign up now for access to the Schachter Energy Research reports.

BULLISH PRESSURE

1. The potential for a pick up in the Middle East war.

2. The Ukrainian success in attacking refineries in western Russia and the Iranian backed Houthis Red Sea and Gulf Of Aden attacks on shipping.

3. OPEC is planning to extend its official cuts to the end of 2024 with the hope this tightens up global inventories and raises oil prices much further. Compliance however is still a problem and there is now more than adequate world supplies.

4. The area to watch now is China demand. It is quite weak now but could rebound if the government's stimulus moves take hold.

BEARISH PRESSURE

EIA Weekly Oil Data

The EIA data released today May 1st showed a healthy increase in inventories. US Commercial Crude Inventories rose 7.3 Mb to 460.9 Mb and are now above last year’s level by 1.3Mb, the first positive comparison in a few years. The Strategic Reserve showed an increase of 0.6 Mb on the week to 366.3 Mb and is above last year’s level of 364.9 MB. Refinery levels fell 1.0 points to 87.5% as there are adequate inventories. Motor gasoline inventories rose 0.3 Mb and are now 4.2 MB above 2023 levels. Distillate fuels saw a decline of 0.6 Mb to 115.9Mb but are 5.5 Mb above last year’s storage levels. Total Stocks including the SPR rose 8.5 Mb to 1,607.9 Mb. Cushing inventories rose 1.1 Mb to 33.5 Mb and highlighted the inventory build. US Exports fell 1.26 Mb/d as world demand has waned. This is a key negative for crude prices in the near term.

US Crude production was flat at 13.1 Mb/d and is up 800 Kb/d above last year’s level. Motor Gasoline consumption rose by 195 Kb/d to 8.62 Mb/d while Jet Fuel saw a fall of 50 Kb/d to 1.71 Mb/d. Total Demand rose 882 Kb/d to 20.4 Mb/d as Propane demand rose 716 Kb/d to 1.16 Mb/d. Year-to-date demand is up 0.3% or at 19.84 Mb/d versus 19.78 Mb/d last year.

OPEC has extended its production cutbacks to the end of June and members are now talking about extending the official cuts to the end of 2024 to curtail inventories and firm prices up even further. OPEC will decide their next move at a face-to-face meeting in Vienna on June 1st.

EIA Weekly Natural Gas Data

The natural gas report out last Thursday showed a large rise in storage levels. The increase was 82 Bcf, with the largest rise in the East at 29 Bcf. This compares to an injection of 75 Bcf last year and the 5-year average injection rate of 42 Bcf. Storage is now at 2.43 Tcf. US Storage is now 22.1% above last year’s level of 1.99 Tcf and 37.0% above the five year average of 1.77 Tcf.

NYMEX is today priced at US$1.92/mcf. The Freeport Texas LNG facility has reopened. Demand in Asia is picking up and Egypt is now importing more LNG as it is in short supply ahead of an expected very hot summer season and high air-conditioning usage.

We recommend buying the very depressed natural gas stocks during periods of market weakness (these stocks are very cheap now) as we see higher prices in Q4/24 and much higher prices in 2025. We plan to add additional natural gas names to our Action BUY list when we get the next low risk energy BUY signal.

Baker Hughes Rig Data

In the data for the week ending April 26th, the US rig count fell six rigs to 613 rigs. Rig activity is now 19% below the level of 755 rigs in 2023. Of the total rigs working last week, 506 were drilling for oil and this is 14% below last year’s level of 591 rigs working. The natural gas rig count is down 35% from last year’s 161 rigs, now at 105 rigs due to the weak natural gas prices at this time. This sharp decline in drilling should continue for a few more months but the industry is seeing declining production. Recent data shows US daily natural gas production at 97 Bcf/d down from the high last year of 106 Bcf/d. Once storage comparisons improve we should see natural gas prices lift.

In Canada, there was a decline of 9 rigs to 118 as spring breakup is underway. Canadian activity is up 27% from last year’s 93 rigs despite this. Activity for oil is at 56 rigs compared to 36 last year or up by 56% as companies add more oil to meet TMX pipeline demand. Activity for natural gas is at 62 rigs compared to 57 last year and condensate rich wells are the focus of this activity. In our discussion with E&P companies they are planning on lower spending during Q1-Q3 due to low natural gas commodity prices. They have mentioned that they might increase activity later in the year, if natural gas prices rise materially as LNG Canada starts up. The industry needs north of $2.50/mcf to see the economics attractive to drill more gas wells. As we get closer to LNG Canada ramping up in Q4/24 and natural gas fills the Coastal GasLink pipeline, prices should lift.

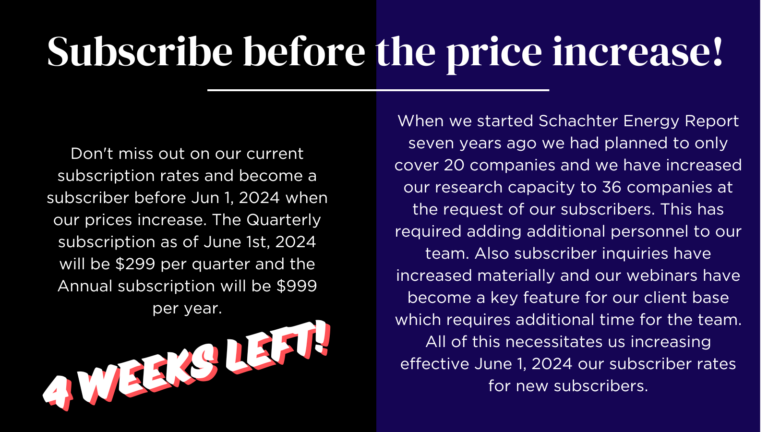

Current subscribers will not be affected by the price change as long as they keep an active subscription. Subscribers who sign up before Jun 1, 2024 will be grandfathered in at the original prices of $249 per quarter or $799 per year as long as their subscription remains active.

Energy Stock Market

The S&P/TSX Energy Index today is at 288, down 19 points since our last issue before our office move. We would not chase the sector here but wait for the developing correction to lower prices and then add to portfolios. We are bulls but we don’t want to chase stocks. We like to BUY when stocks are cheap and are being ignored. That is not the case now. There still are some stocks that are BUYS but that list has shrunk. We cover those that remain cheap in our TOP PICKS NOW section of our SER reports.

Investors should decide what you want your energy weighting to be for this long energy super cycle. Our BUY List includes ideas from the Pipeline & Infrastructure area, Canadian oil and natural gas ideas, energy service ideas and companies working internationally. Our list includes large Conservative ideas and small to large caps in our Growth and Entrepreneurial categories. Add to your current ideas or add new ideas. We expect that WTI should lift above US$90/b in 2H/24 as winter 2024-2025 demand should exceed supplies at that time and we see recovering economies globally.

CONCLUSION

Please take advantage of the current SER pricing structure to become a subscriber before our price increase on June 1st. We are in an exciting energy super cycle and there is a lot more to the upside. To get our specific views and to learn about the companies we cover, become a subscriber. Getting a subscription will help you navigate your energy investments as this cycle unfolds into the end of this decade.

WTI is priced now (as we write this report) at US$79.15/b (low so far today US$78.93/b), down US$8.52/b from our last report. We expect to take advantage of the bargains in energy stock prices with new BUY ideas if one more of our BUY signals is triggered. Down market days for energy stocks are the best days to build your positions for the lengthy energy super cycle we see lasting into the end of the decade.