Important Update: Eye on Energy is Evolving

We have been publishing the weekly Eye on Energy as an extension of the Schachter Energy Report to provide timely and expanded insights on the Energy and World Market. Over time, the volume of information and the effort required to produce this report have grown significantly. As a result, we are transitioning Eye on Energy to a paid subscription model on Substack to ensure its continued quality and sustainability.

Free Access Until September 10, 2025:

Eye on Energy will continue to be available at no cost until September 10, 2025. After this date, readers will have the option to subscribe on Substack at a rate of $30/month or $250/year. To subscribe on Substack go to https://josefschachter.substack.com/

Special Note for Schachter Energy Report Subscribers:

If you are a current subscriber to the Schachter Energy Report, you will continue to receive Eye on Energy as part of your Black Gold subscription at no additional cost.

Limited-Time Offer:

From now until September 30, we are offering a special promotion for those interested in becoming Black Gold subscribers. New annual subscribers will receive $100 off their first year. To redeem this offer, enter coupon code SER100 at checkout using the link below:

https://schachterenergyreport.ca/subscriptions/

We sincerely thank all of our readers for your continued interest and support.

Warm regards,

The Schachter Energy Report Team

Global Economic, Political & Military Update

Summary:

President Trump has announced a trade deal with the EU opening the country to US sales of vehicles, more agricultural goods, wine and mostly energy. Their tariff will be 15% and US goods entering the EU would see no tariff. Prior to the tariff war EU cars paid a 2.5% tariff to enter US markets. Some big numbers were thrown around. Europe would BUY US$750B of energy (crude oil, products and LNG – fully displacing Russia), invest US$600B in creating businesses and high paying jobs in the US – and the biggie – buy massive quantities of military equipment as they move to spend 5% of GDP on defense versus the current 2%. The EU seemed pleased with the deal as they were facing 25% tariffs. However cracks are being seen in that German car makers worry about being viable in the US market as steel and aluminum still face 50% US tariffs. The deal is preliminary and aspirational. Many commentators do not see the numbers as realistic as the US does not have sufficient production of oil and LNG to meet the lofty expectations. Great to announce the deals but the details are lacking. So far no enforcement mechanisms have been seen and there are no formal written agreements. It is likely that the 15% number will be used to move other deals to completion. Opening these markets are good press but what if the foreigners don’t want to buy the products. Items like cars in countries with right hand drives may not see much business as the US auto industry does not focus on this market. Some of the investment funds committed may not be equity investments but may be loans.

Crude oil strengthened over US$70/b for WTI on the back of optimism of global growth as more tariff deals are done. However crude inventories are growing at a time when they should be shrinking (see EIA weekly oil data below).

Tariff revenues are rising for the US Treasury. This month the take could be US$27B and forecasters are suggesting 2025 revenues could be in the US$240B area.

President Trump is now very frustrated with President Putin for not working to end the war in Ukraine. Instead more deadly drone and missile attacks against Ukrainian civilians are occurring and diplomacy is seeing no progress. Trump thought he had a deal weeks ago and now is making scathing attacks against Putin. His 50 day window for a ceasefire deal was shortened to 10-12 days then today to August 8th. He is considering stronger secondary sanctions such as to India to impose a penalty of 25% if they buy Russian energy. India has been a laggard in dealing with the Trump tariff team.

Russia and China have been doing military exercises close to the US. Some near Alaska were joint exercises but recently Russian nuclear submarines have been seen conducting drills just 66 miles from Florida.

The ongoing US stock market rally (new highs for S&P 500 and NASDAQ but not the Dow Jones) has been focused on the AI and tech sectors and is very narrow in leadership. NVIDIA has crossed a market cap of US$4T), a new record market cap for any stock. We saw this same gapping up in early February 2025 just before the Dow fell from 45,100 to 36,600 or a decline in 2.5 months of 19%. With sluggish economic data especially in the consumer areas, we suspect we could see a 20%+ general stock market correction (led by tech) over the coming months. Caveat Emptor! More on this below.

Investors should consider building up some cash reserves and be ready for a material market correction. It could get very nasty in September!

This week’s Eye On Energy Details:

Current Challenges:

Challenges for President Trump and his administration over his second 100 days will be tough: He needs success on these issues before the end of this timeline:

Be able to fund the current deficit and renew maturing Treasury issues when foreign investors worry about US trade policy and support of NATO. China and Japan have been selling some of their substantial Treasury issues.

The current deficit looks to be US$2.2T for this fiscal year, despite June’s US$26B surplus due to tariff revenues. Markets are watching to see how upcoming Treasury offerings do. So far so good! US Interest rate payments are now over US$1T and could rise much more as the debt raised 2, 3 and 4 years ago was at much lower cost. The renewal will add to the interest cost of this budget.

Trump has announced that he would impose a 50% tariff on copper imports as he works to get more of this critical metal produced in the US (now only 50%). Canada gets smacked down again as Canada exports $4.8B of copper concentrate (99% of US imports). Copper prices jumped and were at US$5.50 per pound yesterday up from US$4.23 per pound just a month ago. Next on Trump’s hit list is the pharmaceutical industry where he plans at a “very, very high rate, like 200%,” if deals are not done to lower US prices significantly.

China is now signalling to the US that no trade talks are possible without US concessions on Taiwan. With China agreeing to sell more rare earth critical minerals needed for high tech equipment built in the US, Trump has reversed his decision to hold back sale of NVIDIA and AMD high end semis to China. Those stocks have added to their runs due to this reversal. A bit of progress but not enough.

I remain concerned that other Geopolitical Challenges could take place and be the ‘Black Swan’ to take the general stock markets to our downside targets.

Our expected downside targets are:

Dow Jones Industrials Index 35,000 (now 44,658)

S&P 500 4,800 now (now 6,384)

NASDAQ 15,000 (now 21,182)

S&P/TSX Energy Index 230 (now 278)

WTI US$57-59/b (now US$70.13/b)

We see WTI rising after the next dip and the potential issues that could drive prices quite high in coming years are:

Global growth in late 2025 into 2026 exceeds supplies (Venezuela sanctions impacting as well).

Lack of production growth from the non-OPEC world.

US Production levels flattening as seen in this week’s EIA report.

The Trump tariffs are just having an impact and future months should see much more tariff revenue and higher prices impacting inflation. The US Economy is humming along at a 3% pace and jobs are growing according to the ADP which announced hiring recovered by 104,000 jobs in July. Wage pressure is evident with wages up 4.4% at an annual pace in the month, boxing in the Fed from rate cuts. The Fed noted that ‘inflation remained elevated’.

The Federal Reserve kept interest rates unchanged today despite President Trump’s cajoling. The Fed Funds rate was kept at 4.25 – 4.50%.

If you want to see our Action Alert BUYS and our ongoing research on 37 companies in the energy sector then please sign up now for access to the Schachter Energy Research reports.

BULLISH PRESSURE

1. US Tariffs on imports would raise prices for consumers and businesses. We now need to wait for upcoming data to see what occurs. Tariffs on the EU and Mexico are now at 30%.

2. Venezuela sanctions started on May 27th. Production could now fall in coming quarters from over 1M b/d to less than half that number tightening global supplies unless President Trump reverses course. Secretary of State Rubio wants to increase pressure but some Trump insiders want him to ease restrictions. It will be interesting to see how this inside White House battle is resolved.

3. Non-OPEC supplies are growing slower than initial expectations.

4. Some OPEC members have not invested to increase their production so any quota increase is meaningless.

BEARISH PRESSURE

1.OPEC announced a quota production increase for August of 548,000 b/d. Nice big number but really not realistic. They expected to increase May volumes by 411,000 b/d but only could increase production by 183,000 b/d of which the Saudis increased production by 177,000 b/d. In reality only the Saudis, Kuwait and the UAE could increase volumes but not the number of the quota. The data for June shows an overall increase of only 220 Kb/d and not another 411 Kb/d. Yes, an increase that lifts global stocks but not glutting markets where prices could fall into the US$50’s as some bears are calling for. 2. Demand weakness in many European OECD economies. The UK is feeling inflation with tariffs lifting its annual rate to 3.6%. 3. US and China demand for crude and products is not growing and for some products are declining versus 2024 consumption. 4. Kazakhstan continues to increase production from its Tengiz field (operated by Chevron). Production rose to 64,000 b/d in June. They have an OPEC quota of 1.5 Mb/d but are producing at 1.85 Mb/d. OPEC is furious. 5. The US was an exporter of crude 2.70 Mb/d last week. This is down by 1.16 Mb/d as countries back off buying and use this issue to get an acceptable tariff deal.

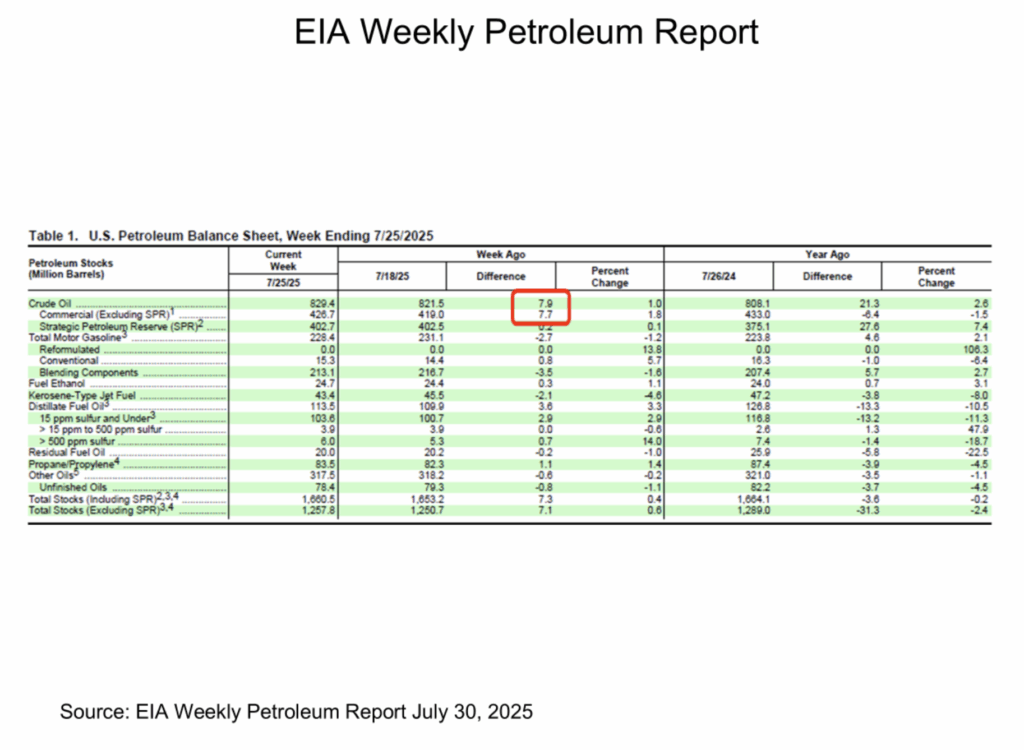

EIA Weekly Oil Data

The EIA data for last week was negative overall. Total Stocks rose 7.3 Mb to 1660.5 Mb, Commercial Stocks rose 7.7 Mb to 426.7 Mb while the SPR gained 0.2 Mb to 402.7 Mb. Motor Gasoline Stocks fell 2.7 Mb while Distillate Fuel inventories rose 3.69 Mb. Exports declined 1.16 Mb/d to 2.70 Mb/d as buyers wait for tariff deals to be completed and then buy US energy as required under the deals. Refinery Utilization fell 0.1% to 95.4% but is substantially above the level of 90.1% in 2024.

US Production rose 41 Kb/d to 13.31 Mb/d and is now up 14 Kb/d from last year’s level of 13.30 Mb/d. Low oil prices are now uneconomic to drill and complete and we are seeing the early stages of the industry cutting back spending due to insufficient returns from current low prices. Overall product demand fell 383 Kb/d to 21.39 Mb/d, as Other Oils saw demand fall 1.123 Mb/d to 5.31 Mb/d. Cheap prices are helping end use buyers but not energy producers. Motor gasoline consumption rose by 185 Kb/d to 9.15 Mb/d. Jet fuel consumption rose 411 Kb/d to 2.09 Mb/d. Cushing Inventories rose 0.7 Mb to 22.6 Mb. This is below the 2024 level of 29.9 Mb.

Overall US demand is up modestly from 2025 at 0.7% to 20.19 Mb/d up from last year’s 20.05 Mb/d while Gasoline demand is down for the year by 0.6% to 8.76 Mb/d from last year’s 8.81 Mb/d.

In the coming weeks crude prices should retreat to the low US$60’s and if demand is weak this summer as consumers restrain from travel then we could see a decline below US$60/b towards the US$57 – US$59/b area. We expect to get our next BUY signal at that time. In Q4/25 crude prices should lift to the US$72 – US$76/b level. Energy related stocks should be great performers as global demand picks up when winter starts.

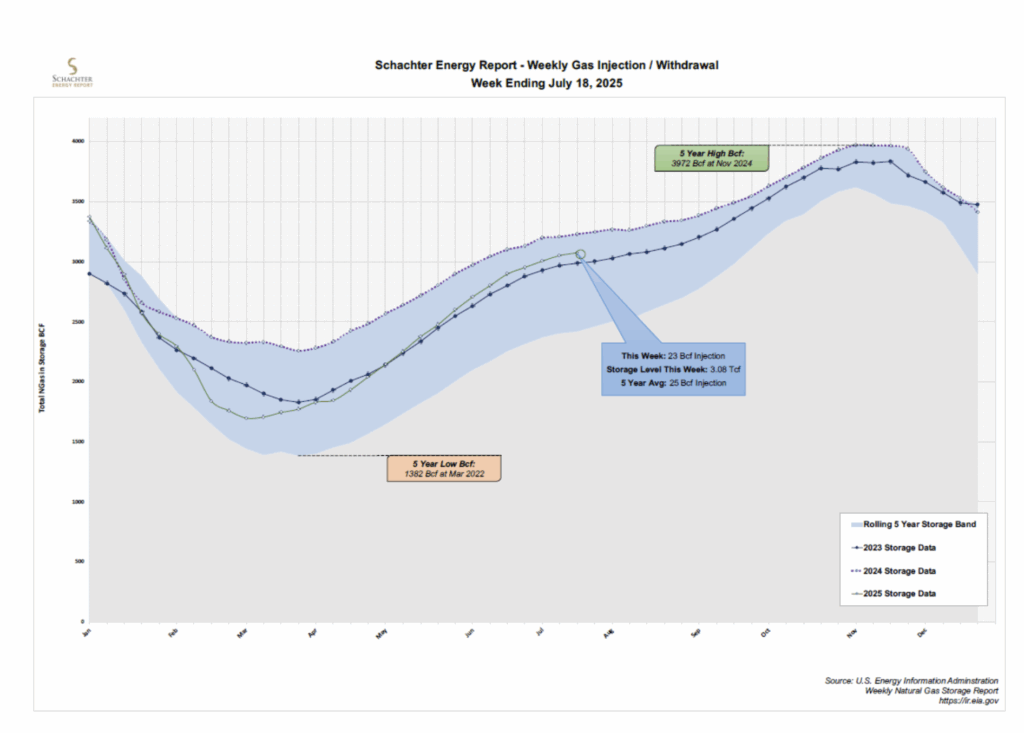

EIA Weekly Natural Gas Data

Last week there was an injection of 23 Bcf (data July 18th). This raised storage to 3.05 Tcf with the biggest increase coming in the Midwest area at up 16 Bcf. NYMEX is now at US$3.04/mcf. In 2024 there was a 22 Bcf injection and for the five-year average, injection was 25 Bcf. Lower injections occur at this time of year due to strong air conditioning demand. US Storage is now 4.7% below last year’s level of 3.23 Tcf and 5.9% above the five year average of 2.90Tcf.

We recommend buying the very depressed natural gas stocks during periods of market weakness. Many natural gas stocks are very cheap now. We see much, much higher gas prices in Q4/25 as quite a number of new LNG plants come onstream over the next 12 months; one in Canada has now ramped up (now four shipments sent to China, Japan and South Korea). The latest Canadian shipment went to China, via a Petro-China tanker called Wudang. Three more tankers are heading to Kitimat to load up in the coming weeks.

In the US Venture Global has commenced production from its Phase 2 of its Plaquemines LNG export terminal in Louisiana. The plant pulled in 2.9 Bcf of feedgas as it filled cargos.

AECO is trading at <C$1.00/mcf, due to a wet summer in western Canada, particularly Alberta and the slower than expected ramp up of LNG Canada Train 1. Once regular operations are reached then one export cargo can be loaded every two days. We look for AECO to rise to over C$3.00/mcf in Q4/25 and over C$3.50/mcf during winter 2025-2026. Operators can hedge all of their 2026 production now at >C$3.00/mcf. Higher prices should come as more LNG plants are planned for the BC coast. European natural gas prices are around US$16/mcf (versus US$12/mcf in Asia) as storage is depleting quite quickly. European inventories are low for this time of year’s stock rebuild. Rebuilding storage to the required 90% level by November 1st for winter 2025-2026 will be a big challenge across Europe and should keep import prices high.

Here is a new chart we developed to show you the ranges of storage over the five year period and how inventories build during the spring and summer into November and then decrease as strong winter demand empties storage as well as consumes current production. We do not believe the US will see storage peak at the 3.97 Tcf level seen in 2024. With increasing demand starting in November and no new storage, quicker withdrawals can be expected this upcoming winter.

Catch the Energy Conference

Registration is Open – Join Industry Leaders at the Catch the Energy Conference!

Tickets are now on sale for the public. Become a subscriber and get two free tickets to the conference (tickets to the public are on sale at $119 per ticket each during the early bird window until September 20th (they then move to $179 each). To find out more go to www.catchtheenergyconference.com . We did sell out last year so if you would like to attend please get your tickets as soon as possible.

As usual SER subscribers will receive two complimentary tickets to the event. We look forward to seeing you there!

We are working away on getting our Presenters for this year’s conference. Below are those already signed up with confirmation forms in. We have met with other companies and will update this list as their confirmations come in. We have room for 45 companies and there are some slots still available. SER subscribers always get two complimentary tickets so please put the event in your calendar for October 18, 2025 if you can come to Calgary.

If you know of any companies with great stories and are public companies then have them reach out to me and we can meet them and see if the company would resonate with our attendees. We expect to have over 800 attendees this year versus just over 700 last year. My contact information is josef@sersinc.ca.

We have signed up additional Presenters since the last Eye on Energy (Cavvy Energy, Stallion Uranium and Revolve Renewable), with more close to sending in their confirmation forms after successful meetings and interest in being a Presenter. We are focused on having our program completed during August. Our attendance marketing has started.

Thank you to our Sponsors, Exhibitors and Presenters. It is going to be a great lineup and largest attendance this year!

Baker Hughes Rig Data

In the data for the week ending July 25th, the US rig count saw a decrease of 2 rigs to 542 rigs. US Rig activity is now 8.0% below the level of 589 rigs working last year. Of the total US rigs working last week, 415 were drilling for oil and this is 13.9% below last year’s level of 482 rigs working. The natural gas rig count is up 20.7% from last year’s 101 rigs, now at 122 rigs. Companies remain financially disciplined despite the Trump administration edict to ‘drill baby drill’. WTI will need to exceed US$80/b for some time before drilling activity picks up materially for crude production to reach new all time highs. Natural gas needs to be over US$4.00 for NYMEX to incentivize natural gas drilling activity on a consistent basis. President Trump is in glee over the lower price of crude and lower gasoline prices; one of his election promises however productive capacity is shrinking. In Canada, there was a 10 rig increase to 182 rigs. This rig activity rate is now down 13.7% compared to last year’s 211 rigs. There were 128 rigs drilling for oil last week down 11.1% from 144 last year. Drilling for natural gas was down 19.4% from 67 rigs to 54 rigs due to weak natural gas prices.

Energy Stock Market

The S&P/TSX Energy Index today is at 278 on the lift in crude on tariff optimism. I still expect a further 10-15% correction.

We like to BUY when stocks are cheap and being ignored. Bargains are clearly being seen now. Late July should provide the next great window to add to favourite positions at prices 10% lower than today. Investors should decide what you want your energy weighting to be for this long energy super cycle. Our BUY List includes ideas from the Pipeline/Infrastructure/Royalty area, Canadian oil and natural gas ideas, energy service ideas and companies working internationally. Our list includes large Conservative ideas and small to large caps in our Growth and Entrepreneurial categories. Add to your current ideas or add new ideas. We expect global demand should exceed supplies at that time. We see WTI prices above US$75/b consistently during 2026.

We are working on our next SER Monthly that should be out to paid SER subscribers July 31st. It will include a new Insider Trading Report and our normal overview comment and Lists. If you are interested in independent analysis of the energy sector and to see our Balance of Evidence sections then become a subscriber. https://schachterenergyreport.ca/subscriptions/

CONCLUSION

Down market days for energy stocks are the best days to build your positions for the lengthy energy super cycle we see lasting into the end of the decade. Subscribe now so you don't miss it!

We see energy having a very rewarding period for investors into year end from upcoming lows. Some of the BUY ideas we show on our SER Recommendation List could see upside of 50% or more into year end if our call of over US$75/b post war occurs.